Additional forecast authors include: Joe Parsons, 禁漫天堂, Director of the Harley Langdale, Jr. Center for Forest Business; and Amanda Lang and Pat Jolley, Forisk Consulting.

Main Takeaways

- Demand for softwood lumber and structural panels is expected to improve in 2024 as interest rates start dropping and single-family housing starts gradually resuming their long-term trajectory.

- Increased softwood lumber mill capacity across the South will add upward pressure on pine sawtimber prices. However, the region’s substantial oversupply of sawtimber trees on the stump is expected to continue exerting strong downward pressure on timber prices.

- Pulpwood prices are expected to decline but at a slower pace and stabilize in the second half of 2024.

Timber Prices

The southwide average stumpage prices for major timber products, excluding pine chip-n-saw, generally experienced a downward trend in 2023, albeit to varying degrees. Notably, prices were mostly still above the pre-pandemic levels.

In Q3 of 2023, the south wide average price for pine sawtimber was $25.98/ton, marginally lower than the average a year ago (TimberMart-South, 2023). Nevertheless, prices vary by state and subregion since timber markets are largely local. Half of the 22 southern timber subregions, mostly in the Southeast, experienced a moderate decline in pine sawtimber prices. Factors such as high interest rates, deteriorated housing affordability, and worries of an economic slowdown dampened the housing market, causing softened demand for lumber.

The south wide average stumpage prices for pine pulpwood and hardwood pulpwood fell sharply in 2023. Pine pulpwood stumpage prices averaged $7.59/ton in Q3 of 2023, marking a 21% decrease year-over-year and a 31% decline from the peak recorded in early 2022. The weakened demand can be attributed to factors such as the continued shift in products within the paper sector, increased utilization of recycled fiber, and reduced demand for lumber. The decline was even more pronounced in subregions having recent paper mill closures.

The average pine sawtimber price dropped 15% to $30/ton in South Georgia and declined 11% to $20.33/ton in North Georgia. The average pine pulpwood stumpage price was $14.88/ton in South Georgia, down 17% year-over-year. Pine pulpwood averaged $7.74/ton prices in North Georgia, down 19% from the recent high in Q4 of 2021.

Compared to stumpage prices, delivered prices for pine sawtimber and pulpwood held better, down 6%–8% year-over-year. The gap between delivered and stumpage prices in Georgia has widened significantly since 2020, primarily due to inflation, coupled with the continual reduction in Georgia’s logging workforce.

2024 Timber Outlook

Over 70% of the softwood lumber and structural panels in the U.S. are used in residential construction, especially in new single-family housing and home improvement activities (Alderman, 2022). In November, single-family housing starts were at a seasonally adjusted annual rate (SAAR) of 1.143 million units, up 13.7% from the 2022 actuals (U.S. Census Bureau, 2023). Single-family building permits, a key indicator for projecting future housing starts, were up 22.8% year-over-year. Projections for single-family housing starts in 2024 vary, with estimates ranging from 914,000 units by Fannie Mae (Duncan et al., 2023), to 1.04 million units (National Association of Realtors, 2023), to 1.072 million units (Mortgage Bankers Association, 2023). Impacted by the slowdown in existing home sales, remodeling and repairing activities are expected to decrease at a moderate rate in 2024 (Joint Center for Housing Studies, 2023).

Despite the current slowdown in housing starts, fundamental factors such as demographics, household formation, growing remote and hybrid workers, a robust job market, rising incomes, low existing home inventory, and the underbuilding over the past decade collectively indicate a favorable outlook for single-family housing starts if interest rates improve.

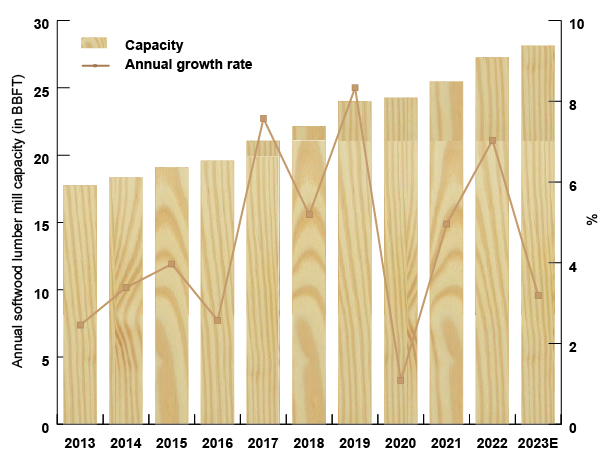

The U.S. South remains a desirable destination for softwood lumber and wood pulping capacity investment. Several factors collectively contribute to the increased capacity, including closeness to markets, ample supply of timber at competitive prices, and established logging and transporting workforce and infrastructure. Noticeably, Canadian-based lumber companies account for a significant proportion of the expansion due to stressed sawlog availability in western Canada and the long-running U.S.-Canada softwood lumber trade dispute. In 2023, southern softwood lumber capacity exceeded 28 billion board feet (BBFT), a 34% increase from 2017 (Figure 1). Announced mill expansion and green field projects suggest an additional 2.5 BBFT of capacity increase by 2025 (Lang, 2023). Southern softwood lumber utilization rate peaked in Q3 of 2021 at 85% due to strong demand for lumber and trended down to 82% in the Q2 of 2023 (Jolley, 2023).

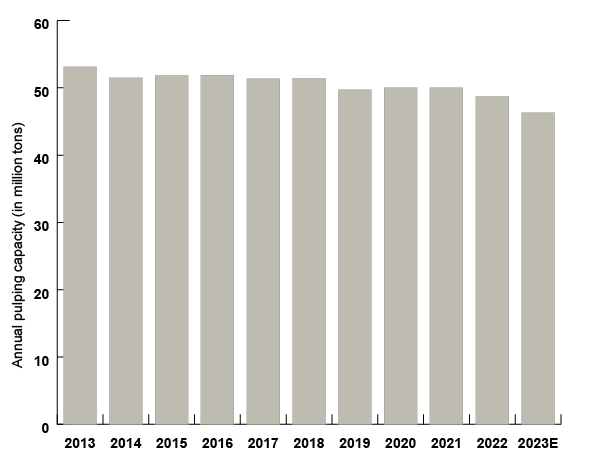

As Figure 2 shows, wood-using pulping capacity continues its decline in 2023 because of product shifts in the paper and paperboard industry and increased utilization of recycled fiber content for pulp production (Lang, 2023). However, investment continues to flow into southern facilities with over $650 million in investment planned between 2022 and 2025.

The 10-year accumulation of underbuilding and the resulting oversupply of sawtimber will likely continue to put downward pressure on pine sawtimber prices across the South. Pine pulpwood prices are likely to remain flat or trend lower as lumber production increases and the structure change in the paper sector continues.

References

Alderman, D. (2022, March). U.S. forest products annual market review and prospects, 2015-2021 (General Technical Report FPL-GTR-289). U.S. Department of Agriculture, U.S. Forest Service.

Duncan, D., Palim, M., Brescia, E., Embrey, N., Drake, N., Goyette, R., Schoshinski, D., Gavin, R. (2023, December 14). Economy to decelerate, but home sales and mortgage originations to begin slow recovery in 2024. Fannie Mae.

Forisk Consulting. (2023). North American forest industry capacity database.

Joint Center for Housing Studies. (2023, October 19). Leading indicator of remodeling activity (LIRA). Harvard University.

Jolley, P. (2023, November 29). Regional forest product mill utilization. Forisk Consulting.

Lang, A. (2023, August 25). Mill investments and closures in the U.S. South. Forisk Consulting.

Mortgage Bankers Association. (2023). Mortgage finance forecast archives.

National Association of Realtors. (2023). Markets with the most pent-up housing demand.

TimberMart-South. (2023). Market bulletin.

U.S. Census Bureau. (2023, December 19). Monthly new residential construction, November 2023.

Status and Revision History

Published on Jan 19, 2024