Introduction

Most cattlemen are familiar with insurance. Examples include insuring buildings against fire, equipment against accidents and lives against death or injury. Purchasing insurance trades the possibility of a large but uncertain loss for a small but certain cost: the insurance premium.

One of the greatest risks cattle producers face is price risk. Price changes can come in the form of declining cattle prices for sellers, increasing cattle prices for buyers or increasing feed prices for feed users.

Because of this risk, producers might want to "insure" feeder cattle, fed cattle or feed against unfavorable price movements, while still being able to take advantage of favorable price movements. Cattlemen have this opportunity by using the commodity options market*.

*Cattle producers can purchase Livestock Risk Protection (LRP) through crop insurance agents. A good reference on LRP for feeder cattle producers is "Livestock Risk Protection Insurance (LRP): How It Works for Feeder Cattle," publication number W 312, available through the University of Tennessee at http://economics.ag.utk.edu/riskmgmt.html.

What is the Commodity Options Market?

The commodity options market is a market in which producers may purchase the opportunity to sell or buy a commodity futures contract at a specified price. Purchasers in options markets have the "opportunity" or "right" but not the "obligation" to exercise their agreement. Therefore, the markets are appropriately named "options markets" since they deal in an option, not an obligation.

Just as a cattleman may purchase the right from an insurance firm to collect on a policy if a building burns, he can purchase the right to sell commodities at a specific price in case prices drop below the specified price. A separate options market also exists to allow the purchase of commodities at a specified price in case prices increase.

For instance, if a cattleman wanted to buy the right to sell feeder cattle for $175/cwt., the feeder cattle options market might provide the opportunity. By paying the market-determined premium, the cattleman could then collect on the option if prices fell below $175/cwt. when the cattle were actually sold. If prices are higher than $175/cwt., the cattle are sold for the higher price, and the cost of the premium is absorbed.

While this is a simplified version of the actual way in which producers might operate in the options market, the reality behind this concept is not much different. Just as with other types of insurance, by paying a premium, insurance can be purchased against price declines or increases. Collecting on the insurance would be an option if the price moves in an unfavorable direction.

The "Ins" and "Outs" of Options: Puts and Calls

There are two types of commodity options: a put option and a call option. The put option gives the holder (usually a commodity seller) the right -- but not the obligation -- to sell the underlying commodity contract to the option writer at a specified price on or before the commodity expiration date. The call option gives the holder (usually a commodity purchaser) the right -- but not the obligation -- to buy the underlying commodity contract from the option writer (seller) at a specified price on or before the option expiration date.

The put option and the call option are two different and distinct contracts. A call option is not the opposite of a put option. Distinguish between the two types of options by remembering that the holder of the put option can choose to "put-it-to-them"; that is, sell the product, while the holder of the call option can "call-upon-'em" to provide the product.

Buyers and Sellers

In the option market, as in every other market, transactions require both buyers and sellers. The buyer of an option is referred to as an option holder. Holders of options may be either seekers of price insurance or speculators.

The seller of an option is sometimes referred to as an option writer. The seller may also be either a speculator or someone who desires partial price protection. The choice to buy (hold) or sell (write) an option depends primarily upon one's objectives.

Buyers and sellers of cattle options "meet" on the Chicago Mercantile Exchange. Rather than physically meeting, all transactions are carried out through brokerage firms that act as the buyer's and seller's representative at the exchange. For this service, the brokerage firm charges a commission. The exchange has no part in the transaction other than to insure its financial integrity. In effect, the exchange offers a place for option buyers and sellers to get together under organized rules of trade.

Strike Price

The "specified price" in the option is referred to as the exercise price or strike price. This is the price at which the underlying commodity contract can be bought or sold and is fixed for any given option, put or call. There could be several options with different strike prices traded during any period of time. If the price of the underlying commodity changes over time, then additional strike prices may be listed for trade.

Underlying Commodity

The "underlying commodity" for the commodity option is not the commodity itself but rather a futures contract for that commodity. For example, an October feeder cattle option is an option to obtain an October feeder cattle futures contract. In this sense, options are the right to buy or sell a futures contract and not the physical commodity.

Because options have futures contracts as their underlying commodity, each option contract represents the same quantity as the underlying futures contract. That is, most grain options represent 5,000 bushels, while the live cattle option represents 40,000 pounds of fed cattle. The feeder cattle option represents 50,000 pounds of feeder cattle. Options are traded for each of the futures contract months in each of these commodities. A table showing the option contract specifications for feeder cattle and live cattle is shown at the end of this bulletin (Table 1).

Expiration

Futures contracts have a definite predetermined maturity date during the delivery month. Likewise, options have a date at which they mature and expire. The specific date of expiration for the feeder cattle option contract is the same as its underlying futures contract -- the last Thursday of each month, with the exception of November and any month when a holiday falls on the last Thursday or any of the four weekdays prior to that Thursday.

Because fed cattle futures contracts can be settled by physically delivering the cattle, the fed cattle option contract expires the first Friday of the futures contract month, prior to the futures contract expiration around the 20th of the month. For example, a $175/cwt. October fed cattle put option is an opportunity to sell one October live cattle futures contract at $175/cwt. The holder can execute this option on any business day until the first Friday in October.

Option Premiums

The option writer is willing to incur an obligation in return for some compensation. The compensation is called the option premium. Using the insurance analogy, a premium is paid on an insurance policy to gain the coverage it provides. Similarly, an option premium is paid to gain the rights granted in the option. The option premium is determined either by public outcry and acceptance in an exchange trading pit or electronically through a "virtual" trading pit. Like all commodity prices, option premiums can be expected to change not only daily but often by the minute.

While the interaction of supply and demand for options will ultimately determine the option premium, two major factors will interact to affect the level of premiums. The first factor is the difference between the strike price of the option and the futures price of the underlying commodity.

This differential in prices may give the option "intrinsic" or exercise value. For example, consider an October feeder cattle put option with a strike price of $175/ cwt. and the underlying October feeder cattle futures with a current price of $172/cwt. The option could be sold for at least $3/cwt. since anyone would be willing to purchase the right to sell at $175 when the market is currently $172. This $3 is said to be the intrinsic value. As long as the market price on the option's underlying futures contract is below the strike price on a put option, the option has intrinsic value. The converse of the price relationship is true for a call option. A call option has intrinsic value when the futures market price is above the strike price.

Any option that has intrinsic value is said to be "in-the-money." An "in-the-money" option has value to others because the futures market price is below the put or above the call strike price. An option is said to be "out-of-the-money" and has no intrinsic value if the current futures market price is above the put or below the call strike price. When the futures market price of the commodity and the strike price are equal, the option is said to be "at-the-money," and has no intrinsic value.

A second factor influencing the option premium is the length of time to expiration of the option. Assuming all else is held constant, option premiums usually decline in value as the time to expiration decreases. This phenomenon reflects the time value of an option. For example, in August the time premium on a $175 September feeder cattle option will be less than the premium on a $175 November option. The option with a longer time to expiration has a greater probability of moving "in-the-money" than the option with less time. Therefore, it is worth more on that factor alone. The longer the time period, the greater the chance that events will occur that could cause substantial movement in futures prices and change the value of the option. As a result, the option writer requires a greater premium to assume the risk of writing a longer-term option.

"Out-of-the-money" options have a value that reflects time value. "In-the-money" options possess both time value and intrinsic value. The total cost of a premium minus the intrinsic value yields the time value of an option (Time Value = Premium - Intrinsic Value).

Offsetting an Option

The method by which most holders of "in-the-money" options realize accrued profit is by resale of the option. This is referred to as "offsetting" an option position and completing a round turn (the buy and sell or the sell and buy of an option). Options can be offset anytime between their purchase and expiration date if the holder so desires. Most option buyers will offset their position rather than exercise the option to avoid losing any remaining time premium and (or) assuming a futures market position and its resultant decisions, margin deposits and commissions. In most situations, the option can be resold to another trader at a premium at least equivalent to the intrinsic value that results from an "in-the-money" price relationship.

Another method by which the holder of an option could realize accrued profits is by "exercising" the option. Options are only exercised at the direction of the owner or if there is intrinsic value at expiration. The opportunity to exercise the option means the option buyer can always get the intrinsic value of the option premium even if there is little or no trading in the option being held. It also provides for a means of continuing price protection after the option expires.

If the decision is made to exercise, the following procedures are followed. For a put, the holder is assigned a short (sell) position in the futures market equal to the strike price. At the same time, the option writer is obligated to take a long (buy) futures position at the same price. Both positions are then adjusted to reflect the current settlement price. It is rational to exercise a put option only when the futures market price is below the strike price, so the holder's futures position will show a profit. The futures position of the writer will show an equivalent loss. At this point the option contract has been fulfilled and both parties are free to trade their futures contracts as they see fit.

Evaluating and Using Options Markets

Now that the mechanics of options trading have been explored, it is time to consider two critical questions: 1) What do varying strike prices mean in terms of price insurance? and 2) How does a producer actually obtain this insurance?

There are three steps to consider in evaluating option prices.

- Select the appropriate option contract month. To do this, select the option whose underlying futures will expire closest to, but not before, the time the physical commodity will be sold or purchased.

For example, if a group of feeder calves were to be sold in early October, the October option would be appropriate. - Select the appropriate type of option. To insure products for sale at a later time against price declines, the producer would be interested in buying a put (the right to sell). If the producer's motive is to insure future commodity purchases against cost increases (for instance, corn needed to feed cattle), then purchasing a call would be an appropriate strategy.

To continue the example: If the cattleman wishes to insure the feeders he will be selling in early October, then he will be interested in purchasing an October put option. - Calculate the minimum cash selling price being offered by the put option selected. For a call option, the maximum purchase price would need to be calculated. These calculations can be accomplished in five steps:

- Select a strike price within the option month. For instance, a $175/cwt. October feeder cattle put.

- Subtract the premium from the strike price for a put or add the premium for a call. For example, if a $175 October put costs $2.75/cwt., the result is $175 - $2.75 = $172.25/cwt.

- Subtract (for a put) or add (for a call) the "opportunity cost" of paying the premium for the period it will be outstanding. For example, if the option premium of $2.75/cwt. is paid in June and the option is expected to be liquidated by an offsetting resale in early October, an interest cost for the three-month period needs to be added. If borrowed funds are used and the interest rate is 9 percent, then the interest (opportunity) cost would be .75 percent per month, or 2.25 percent for three months. The interest cost associated with a $2.75/cwt. put option premium would be $0.06/cwt. This leaves a net price of $172.25 - $0.06 = $172.19/cwt.

- Subtract (for a put) or add (for a call) the commission fee for both buying and offsetting the option. Assume the brokerage firm charges $75 per round turn for handling each option contract. The commission fee would be $0.15/cwt. ($75 for 50,000 lbs., $75/500 cwt.). The net price is now $172.19 - $0.15 = $172.04/ cwt.

- One final adjustment must be made to these prices. The option strike price must be localized to reflect the difference between prices in the local markets where the cattle will be sold or grains purchased, and the futures market price. This difference is called basis (Basis = Local Cash Price - Futures Price). The basis differs for cattle at different weights, sex, location and time of year across the country. See ½ûÂþÌìÌà Extension Bulletin 1406, "Understanding and Using Cattle Basis in Managing Price Risk" for some of the factors that affect cattle basis. Many state Extension offices have historical basis estimates for cattle and inputs that may be helpful in determining the appropriate basis.

Basis estimation is a critical component in estimating the expected net purchase or sale price. Interested readers should also consult ½ûÂþÌìÌà Extension Bulletin 1406, "Understanding and Using Cattle Basis in Managing Price Risk" to help them better understand the various factors that can affect basis.

By adjusting the option price for basis, a minimum selling price can be obtained for a put or a maximum purchase price obtained for a call. For the example, if in early October, 600 lb. feeder steers normally bring $10/cwt. less than the feeder cattle futures market, then the likely minimum local cash price becomes $172.04 - $10 = $162.04/cwt. In the end, the only thing that will change this price is the fluctuation in the basis.

More or less price insurance can be purchased by buying options with different strike prices. To determine the minimum selling price suggested by each strike price, repeat steps one through five for the various strike prices and their associated premiums.

Options Arithmetic: Two Examples

Once the relevant options prices have been evaluated, the next question is, how would the producer go about obtaining a certain level of price insurance? Two examples, one using a put to establish a price floor (an expected minimum selling price) and one using a call to establish a price ceiling (an expected maximum purchase price), will help illustrate the total process.

Put Option Example

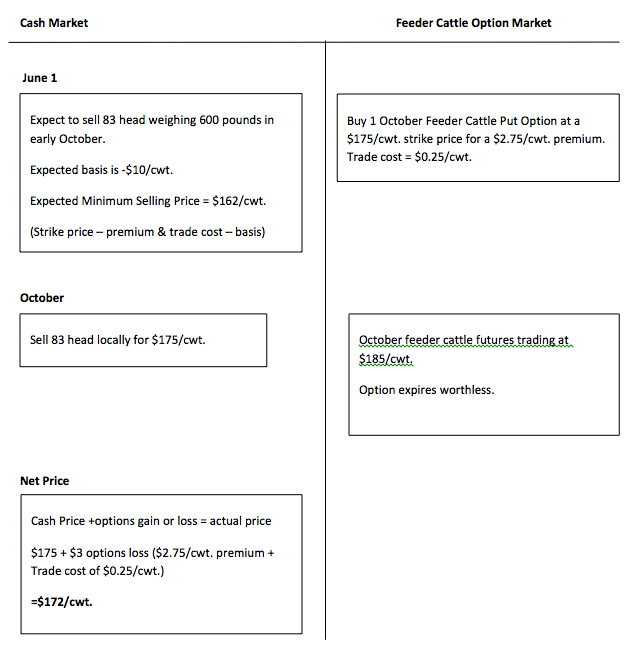

In the following put option example (Figures 1 and 2), we discuss a cattleman who will be selling a load of feeder cattle in early October. In our example, he checks the options quotes in June and finds he could purchase an October feeder cattle put option to sell at $175/cwt. at a premium of $2.75/cwt. To further localize this strike price, he subtracts $10/cwt. basis since he normally sells 600 lb. steer calves for a somewhat lower local cash price in October than the October futures price. Commission ($75 per contract) and interest on the premium cost will be about $0.25/cwt., so the $175 put would provide an expected minimum selling price of $175 - $10 - $2.75 - $0.25, or $162/cwt. By comparing this with his other pricing alternatives and his production cost, he decides that purchasing this put would be an appropriate strategy for the 83 steers he plans to sell in October. He advises his broker that he wants to purchase one "$175 October feeder cattle put at $2.75." He then forwards a check for $1,450 (500 cwt. X $2.75/cwt. plus $75 brokerage fee) to his broker.

As October approaches, one of three things will happen: prices will stay relatively unchanged, rise above the option strike price (thus making the option worthless) or fall below the strike price (thus making the producer's option valuable). Remember that for a put option, if the current futures price is above the strike price, the option is said to be "out-of-the-money." If futures are below the strike price, it is "in-the-money."

First, assume the futures market prices in early October are $185/cwt. -- well above the put option strike price of $175/cwt. This makes the producer's option "out-of-the-money." Since no one is willing to pay for an option to sell at $175/cwt. when they could sell currently for $185/cwt., the option expires as worthless (Figure 1). In this case, the cattleman sells the load of feeders and does not use the option. The net price would be the cash price received less the net premium cost originally paid. Assuming the basis did not change (-$10/cwt.) and the cattle brought $175/cwt., the actual net received would be $172/cwt. ($185 - $10 basis - $2.75 premium - $0.25 commission and interest).

In this case, the insurance policy was not needed. Had this been known in advance, the cattleman could have saved the premium. However, just as fire or other disasters can't be predicted, price movements can't be predicted with accuracy either. For this reason, the cattleman was willing to substitute the known loss (premium) for the possibility of a larger unknown loss.

Figure 1. Put Option Example. Feeder cattle pricing example where the option expires as worthless.

Figure 1. Put Option Example. Feeder cattle pricing example where the option expires as worthless.

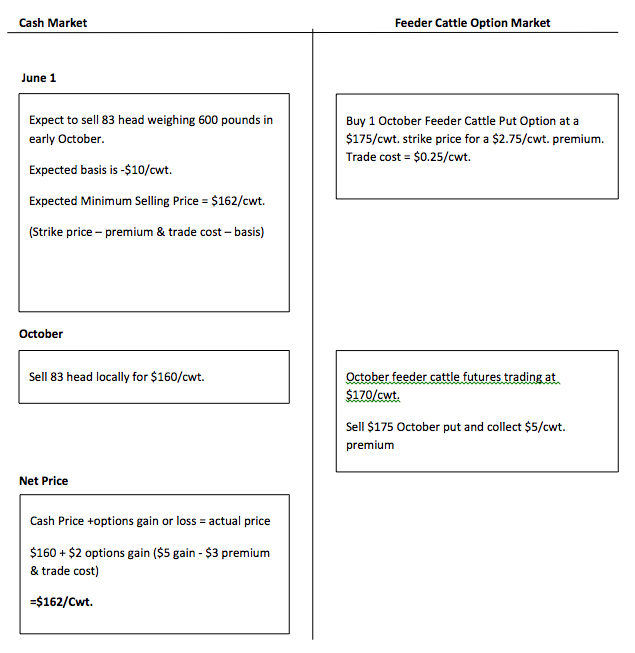

Figure 2. Put Option Example. Feeder Cattle Pricing Example where market declines and option is sold.

Figure 2. Put Option Example. Feeder Cattle Pricing Example where market declines and option is sold.What happens if the cattleman does need to collect on his option position? The mechanics of this instance are shown in Figure 2. Assume the futures market price at the first of October is $170/cwt. In this case, the option to sell does have value, because others are willing to purchase the right to sell at $175 when they are currently only able to sell at $170/cwt. Remember, this means the option is "in-the-money." One way to collect on an options policy (offset) is very much like collecting on insurance. Since the value of the loss is $5/cwt., the cattleman should be able to sell the option back for at least this amount. He calls his broker and tells him to sell the October put at $5 or better. The sale of a previously bought put cancels the option, and the broker sends a check for $5 per cwt. X 500 cwt. or $2,500. Since he paid a premium of $2.75/cwt. plus the $0.25/ cwt. option trading cost, he really netted $2/cwt. on the option trade. The producer sells his calves for $160/ cwt. on the cash market and adds the $2/cwt. gained on the option market to get the net price of $162/ cwt. Thus, the option was successful in assuring the minimum price when he bought it in June.

In this case, the producer collected on his option (policy). Just as with insurance, he collects to the extent of his loss. In options terminology, we are talking about the strike price (the face amount of the policy) less the current futures price of feeder cattle.

A second way in which the "insurance" could have been recovered would be to exercise the option, converting it into a sell (short) position in the futures market. If the futures position were then immediately closed out with a purchased October futures (long), the $5/cwt. difference would be realized ($175 - $170 current futures) with only an additional commission for the futures purchase. Since fed cattle options expire before the underlying futures, this may be the route to completing the options "insurance" if the cattle were not sold until after the option had expired. With feeder cattle, however, this is not a problem, because the futures and options expire together.

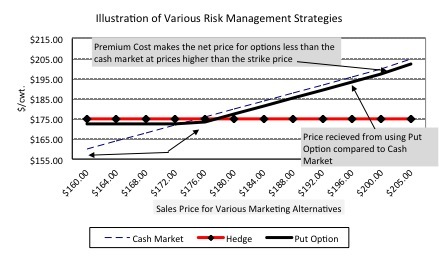

Figure 3 summarizes the resulting net price from purchasing an October put for $2.75/cwt. with $0.25/ cwt. trading cost under several futures market prices in October and a realized -$10/cwt. basis. It also makes clear why put option purchases are sometimes referred to as "floor pricing."

Figure 3.

Figure 3.In reality, the producer will only be able to estimate what his basis will be when he sells the cattle. If the actual basis is better (stronger) than anticipated, then the realized net price from the options will be higher. If the actual basis is worse (weaker) than anticipated, then the realized net price from the options will be lower. In either case, the actual net price will vary by the difference in forecast and actual basis.

Buying More or Less Insurance

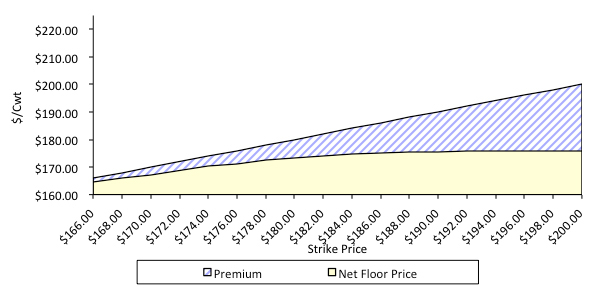

Figure 4 shows the net futures floor prices achieved at various strike prices. Basis would still need to be subtracted to arrive at an estimated cash price.

Figure 4. Net futures prices for put option at various strike levels. Nov FC contract. Prices quoted in June.

Figure 4. Net futures prices for put option at various strike levels. Nov FC contract. Prices quoted in June.

The crosshatched area indicates the amount of the premium paid. For instance, a $180 put could have been purchased for $6.70/cwt. This would have provided a higher floor price but at an unreasonable expense. Alternatively, a $170 put could be purchased for $3/ cwt., providing a net futures price of $169. Finally, a $166 put would have cost only $1.30/cwt. but provided a futures floor of only $164.70/cwt. Again, readers are reminded that these prices are calculated before any basis adjustment. So, if the basis is -$10/cwt., as has been used throughout this publication, then net cash prices will range from $164.70 to $175.90/cwt.

This graphic illustrates the impacts of strike prices and premiums on net futures prices. Selecting the "right" strike price involves knowing not only what level of protection is afforded, but also how much the protection costs.

Call Option Example

As mentioned previously, call options can be used to establish an expected maximum purchase price. Call options may be useful for stocker operators or feedlots to set a maximum purchase price of incoming cattle. Likewise, livestock producers can use corn or soybean meal options to set a maximum purchase price for feed ingredients. Similar to a put option establishing a price floor, call options establish a price ceiling.

Call options give the holder the right but not the obligation to BUY a futures contract at a given price. The same terms (strike price, premium, etc.) apply for call options as they do with put options except the objective is to set a maximum purchase price for feeder cattle, live cattle or feed ingredients as opposed to a minimum price. As a result, premiums and other transaction costs are added to the strike price in calculating the net price paid, where with put options they were subtracted. In either instance, the result is the same. The holder experiences a small but known loss in exchange for mitigating the risk of upward price movements in the market.

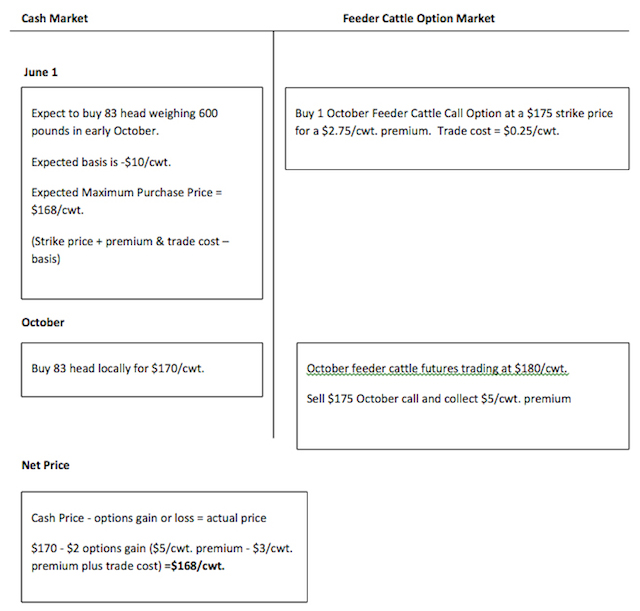

To illustrate a call option, consider the feeder cattle example presented for the put option (Figure 5) except that a feeder cattle buyer wants to set a maximum purchase price of $168/cwt.

Figure 5. Call Option Example. Feeder Cattle Price Increase Example.

Figure 5. Call Option Example. Feeder Cattle Price Increase Example.

In this instance, prices increased enough to make the call option "in-the-money." As result, the owner offset the option for the intrinsic value and reduced his net purchase price to $168/cwt.

If the futures market had gone down to, say, $165/cwt., the cattleman would have purchased the cattle for $155/cwt. ($165 - $10 basis) and let his call expire as worthless. Because his total purchase price (premium + commission + interest) was $3/cwt., his net purchase price would have been $158/cwt.

Summary

Purchasing options for price insurance is a way cattlemen can use the futures markets as a pricing alternative. This alternative should be carefully compared to all other pricing alternatives in light of the producer's objectives and risk-bearing ability. Options purchased for price insurance provide a "hybrid" market with characteristics of both doing nothing (cash market pricing) and hedging or forward-contracting. That is, the producer who purchases an option for price insurance has some of the same price protection offered through a hedge or forward contract. On the other hand, options are not as protective against unfavorable price movements as hedging or forward contracting or as attractive as the open cash market if prices become more favorable. In fact, option purchases will always be, at best, second to either of the other two pricing alternatives when evaluated after the fact. However, cattlemen do not have the luxury of making pricing decision after the fact. Because of this, many cattlemen may find a place in their pricing plans for the kind of "hybrid vigor" offered through the option market.

Table 1. Comparison of Options Specifications

| Item | Feeder Cattle | Live Cattle |

| Underlying Contract Size | 50,000 pounds | 40,000 pounds |

| Delivery | Cash settled | Physically delivered |

| Months traded | Jan, Mar, Apr, May, Aug, Sep, Oct and Nov | Feb, Apr, Jun, Aug, Oct, Dec |

| Last day of trading1 |

Last Thursday of the contract month with exceptions for November and other months when a holiday falls on the last Thursday or any of the four weekdays prior to that Thursday, 12:00 p.m.

See CME Rule 102A01.I. |

First Friday of the contract month, 1:00 p.m.

See CME Rule 101A01.I. |

| 1 Source CME website - accessed May 27, 2014 http://www.cmegroup.com/trading/agricultural/livestock/feeder-cattle_contractSpecs_options.html http://www.cmegroup.com/trading/agricultural/livestock/live-cattle_contractSpecs_options.html | ||

Status and Revision History

Published on Jun 17, 2014