Your personal identity is unique to you. The way you dress, the jokes that make you laugh, the TV shows you enjoy the most… these things make you who you are. People know you by these things. You may not realize that you also have a unique identity as a citizen, a taxpayer, and a consumer. The government, your employer, and lenders know you by the data that identifies you in these roles.

Your personal identity cannot be taken from you, but your identifying information—your Social Security number and other details about you—certainly can be. If your identifying data is used without your permission for another person’s dishonest objectives, you become a victim of an identity theft crime.

Identity thieves use your government or consumer identity information for their own gain. For example, someone steals your credit card number to go on an online shopping spree, or a criminal uses your Social Security number to create a false identity.

Through possession of your identifying information, thieves can also gain access to your credit profile, enabling them to buy a car, rent an apartment, or open new credit cards using your good name.

Unfortunately, you pay the price for identity theft. Even though laws limit a victim of identity theft’s losses, having your identity stolen can cause serious problems. You may be refused for jobs, housing, or loans. You can even be arrested for crimes you did not commit.

If you are a victim of identity theft, it is likely you will have to spend months—maybe years—clearing your name of the wrongdoing of others. This may result in a loss of time at work and of pay, put strain on relationships, and cause harmful stress levels.

In this digital age, it is more important than ever to protect yourself from identity theft. Your identifying information is valuable to thieves. Take steps to protect yourself from identity theft. Act today to ensure that your data does not fall into the wrong hands.

Steps to Avoid Identity Theft

To protect your identity, you must make it difficult for thieves to get the information needed to commit their crimes. Start today with the following suggestions to make sure your personal information remains as unique to you as the color of your eyes or your favorite foods.

- Be careful about giving out personal information. The most sought-after piece of personal information is your Social Security number, so make protecting it your first priority. Unless you initiated the transaction and know exactly who you are dealing with and why they need it, never provide your Social Security number or other key personal information. Ask medical offices and other organizations to assign a number other than your Social Security number to identify your accounts.

- Protect your credit cards. Carry only the cards you use, and keep your wallet or purse where you can see it. Don’t write your PIN number anywhere on the card. Activate new cards immediately. Then sign the back of each card and write “See I.D.” A card signed in this manner makes fraudulent use more difficult. If your purse or wallet is stolen, immediately report the loss to your financial institution and credit reporting agencies so that a fraud alert can be placed on your accounts.

- Order a copy of your credit report annually and look over it carefully. Go to or call 877-322-8228 to order your report. When you receive it, compare the account numbers on all active accounts to your own records for those accounts. Look for accounts you did not open or balances that you did not charge. If you find any discrepancies, take the time to investigate, following the instructions provided by the credit reporting agency that issued the report. The following section, “Requesting Your Credit Report,” will provide more information on how to check your credit reports.

- Destroy all papers that carry personal information. Shred sensitive paper before putting it into the trash or recycling bin. Never throw unopened junk mail directly into the waste bin. Instead, open and destroy any pieces with your name, address, and personal information. If possible, mail payments by dropping them inside the post office instead of leaving them in your mailbox for carrier pick-up.

- Take care of your bank accounts. Get to know the people at your local banking branch, so they will be able to spot an impostor if your checkbook is stolen. Have your checks printed with only your initials instead of your full first name. Thieves may not know your first name, and if they guess incorrectly, the bank may identify the check as suspicious. If you have a post office box, use that address instead of your residence address on your checks, and never preprint your driver’s license or Social Security numbers on the checks.

Requesting Your Credit Report

Credit reporting agencies gather information from businesses, banks, and public records to create files of information on your financial life. Each of these companies, including Equifax, Experian, TransUnion and more recently a fourth agency, Innovis, receives information from different sources, so it’s important to request your reports from all four companies.

Regular review of your credit reports provides the best way to detect financial identity theft. By requesting and examining your credit reports on a consistent schedule, you will become familiar with what you should expect to find there, improving your ability to spot unexpected activity if it appears. Federal and Georgia laws make it possible to receive your credit reports for free.

Federal law requires that all credit reporting agencies provide you with one free credit report every 12 months. You must request these reports in order to receive them. Visit www.annualcreditreport.com, call 877-322-8228, or mail in your request using the letter on page 4 as a guide. You may request reports from all the credit reporting agencies at once, or spread your requests across different months. Printable reports can be viewed online, or you may request to have the reports mailed to you. To receive your free annual credit report from Innovis, you must call, visit their website, or write a letter of request.

Georgia law permits you to receive two additional free credit reports annually from each credit reporting agency. To request these reports, you will need to visit each agency’s website, call, or write a letter. You must make a separate request to each credit reporting agency.

Every credit report request requires your Social Security number, so be careful. Follow these tips when submitting a request:

- If mailing your request, safeguard your Social Security number by properly sealing the envelope and putting the letter in the mail slot inside your local post office.

- If requesting online, always confirm that you are at the credit reporting agency’s official website, and look for the closed padlock icon after the URL in the browser bar.

|

Credit Reporting Agency Contact Info |

|

|

EQUIFAX

Equifax Information Services

EXPERIAN

Experian

|

TRANSUNION

TransUnion LLC

INNOVIS

Innovis

|

Make an ordering plan

For the best protection from identity theft, make a habit of requesting and reviewing your credit reports. It won’t take more than a few minutes to go online, make a phone call or write a letter. Those few minutes will give you peace of mind. Choose one of the plans below and stick with it.

PLAN 1: Request reports once a year.

Order a report from all four major credit reporting agencies each year for a total of four reports annually. Order credit reports from all four at once in a chosen month, or spread them out over the year.

| Chosen Month | OR | January | April | August | December |

Order one of each under federal law:

|

Order EQUIFAX report under federal law | Order EXPERIAN report under federal law | Order TRANSUNION report under federal law |

Order INNOVIS report under federal law |

PLAN 2: Request reports three times each year.

To see the activity on your credit reports more frequently, order a full set of reports in three different months for a total of 12 reports annually. (Applies to Georgia residents only; laws for additional credit reports vary by state.)

| January | May | September |

Order one of each under federal law:

|

Order one of each under federal law:

|

Order one of each under federal law:

|

PLAN 3: Request a report each month.

Order a report each month for a total of 12 reports annually. This plan allows you to see the activity on your reports most frequently. (This applies to Georgia residents only; other states may have different rules for the second and

third reports.)

| January | February | March | April | May | June |

| Order EQUIFAX report under federal law | Order EXPERIAN report under federal law | Order TRANSUNION report under federal law | Order INNOVIS report under federal law | Order EQUIFAX report under federal law | Order EXPERIAN report under federal law |

| July | August | September | October | November | December |

| Order TRANSUNION report under federal law | Order INNOVIS report under federal law | Order EQUIFAX report under federal law | Order EXPERIAN report under federal law | Order TRANSUNION report under federal law | Order INNOVIS report under federal law |

Checking your credit reports frequently will not have a negative effect on your credit rating or score. This is because it is considered a “soft” inquiry, unlike inquiries that imply you will soon be taking on more debt.

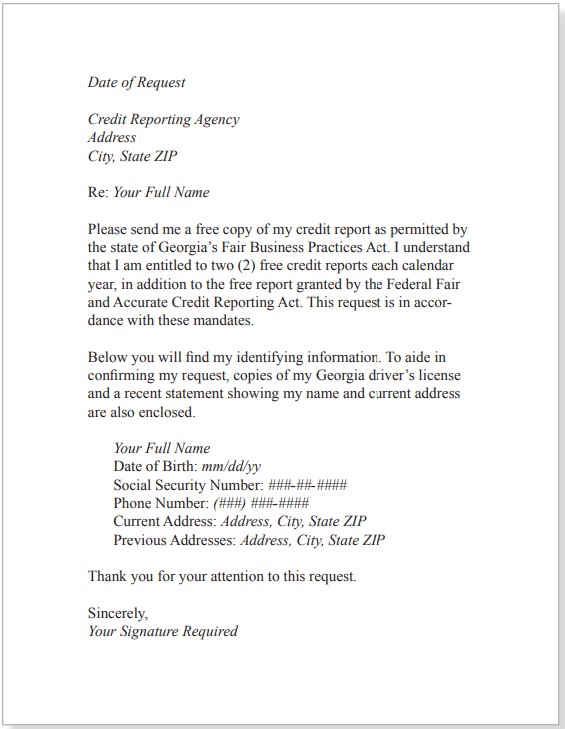

Writing a request letter

Below is a sample letter to copy if you want to request your credit report by mail. Type or handwrite the letter as you see it here, replacing the italic text with the correct information.

Be sure to enclose copies of 1) your Georgia driver’s license or ID card and 2) a recent utility bill or bank statement showing your name and current address. Do not send a copy of your Social Security card. Include previous addresses from the past two years if applicable.

Keep a record of your credit report requests

Use this sheet to make sure you request, receive and review your credit reports on a timely basis. Also take a minute to mark your calendar with your next planned request date.

| Date Requested | Credit Agency Requested From | Free Report Under Which Law? | Method of Request | Date(s) Received | Notes |

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail | ||||

| [ ] Federal [ ] Georgia | [ ] Online [ ] Phone [ ] Mail |

Reviewing Your Credit Report

You can save hours of trouble simply by taking just a few minutes to review your credit report. In order to detect identity theft or fraud, it’s important to know what to look for. Use the following suggestions to guide you when reviewing the reports you receive. Should you find evidence of fraud, you’ll need to act immediately.

Regular review of your credit reports provides the best way to detect financial identity theft. By requesting and examining your credit reports on a consistent schedule, you will become familiar with what you should expect to find there, improving your ability to spot unexpected activity if it appears. Federal and Georgia laws make it possible to receive your credit reports for free.

| Credit Report Section | What to Look For |

| Personal information: Name, current and previous addresses, current and previous employers, your Social Security number, telephone number, and date of birth are listed. |

|

| Payment history: Shows information about credit accounts opened in your name or accounts for which you are an authorized user. For each account, the creditor’s name, your account number, dates the account was opened, updated or closed, how much has been borrowed, how much is owed, the credit limit, and the repayment history are listed. |

|

| Inquiries: A record of each request to access your credit file will be listed. This may include consumer-initiated inquiries (initiated to determine your credit-worthiness) and promotional and administrative inquiries (including preapproved offers, inquiries by employers, account monitoring by existing creditors, and your own requests for your credit report). |

|

| Public records: Information about tax liens, child support debts, bankruptcies, and court judgments may be listed. |

|

If You Find Something Suspicious on a Credit Report, Take Action!

Should you suspect identity theft, it is important to take immediate action. Take these steps to get started:

1. Place a 90-day initial fraud alert. Contact one credit reporting agency from the list below and report that you suspect you’ve been a victim of identity theft. Ask the company to place a fraud alert on your credit file. Confirm that the company will inform the other two agencies about this fraud alert. This alert can be renewed in 90 days, if needed.

| EQUIFAX 800-525-6285 |

EXPERIAN 888-397-3742 |

TRANSUNION 800-680-7289 |

INNOVIS 800-540-2505 |

| Equifax Info. Services PO Box 105851 Atlanta, GA 30348 |

Experian PO Box 2002 Allen, TX 75013 |

TransUnion LLC PO Box 1000 Chester, PA 19022 |

Innovis Consumer Assistance PO Box 26 Pittsburgh, PA 15230-1689 |

2. Order your credit reports. Review each report carefully, using suggestions previously mentioned. If you find accounts that have been compromised, contact the business(es) involved and speak to their fraud department. Always follow up with a letter (sent certified-mail, return receipt requested) confirming details of this conversation.

3. Create an "Identity Theft Report." Begin the process of completing an “Identity Theft Report” by filing a complaint about the theft with the Federal Trade Commission at www.ftc.gov/complaint. Follow the instructions there to complete the three steps necessary to complete the report.

Keep a record of all communications regarding a suspected identity theft. Whether communicating by phone, mail or online, write down the date of the contact, the names of those you are in contact with, and note the answers and information you receive. For a comprehensive guide on responding to identity theft, visit www.consumer.ftc.gov/articles/pdf-0009-takingcharge.pdf

Freeze Your Credit Reports

Under Georgia law, you have the right to place a security freeze on your credit reports. This will lock your reports, making them unavailable to outside parties without your authorization. While freezing your reports could cause an occasional inconvenience, think about making it a part of your identity theft protection strategy.

A freeze blocks access to your reports. If you want your credit information released, you must contact the credit reporting agency to temporarily “thaw” your account. This can delay some credit transactions.

Contact each credit reporting agency separately to request the freeze—procedures may vary. A small fee may apply. In most cases you will be charged $3 per credit agency to have the freeze placed on your account.

You will receive a notice such as this one with each credit report you’ve requested:

|

Georgia Consumers Have the Right to Obtain a Security Freeze

|

Are You Putting Yourself at Risk for Identity Theft?

The following activity will help you determine if your actions are putting you at risk for identity theft. Put an X next to each statement that describes something you do.

For each item you did not mark, congratulations! You are already taking action toward keeping your identifying information secure. Keep up the good work by following the suggestions that correspond to the item you marked.

| I put my unopened junk mail directly into the trash or recycling bin. | Dumpster-divers and trash scavengers can easily retrieve your discarded mail and gather profitable information about you. Purchase a crosscut shredder and shred every paper that has personal information on it before putting it out on the curb. |

|

| I discard my credit card statements without looking at them. | Always look over charges on credit card statements. You have 60 days under federal law to dispute any charges. If you fail to notify the company within the allotted time, you'll be liable for the charge as well as any finance charges that might apply |

|

| I place bill payments and other financially sensitive mail in my residence mailbox for carrier pickup. | Your residence mailbox is likely to be accessible to anyone, not just the mail carrier. Whenever you must mail a payment or letter with identifying information and/or account numbers, take it to the post office and drop it off inside the building | |

| I’ve checked my credit report(s)… but not for a few years. | A current credit report is your first line of defense against identity theft. Federal law entitles you to receive a free credit report from each credit reporting agency—request and review your credit reports annually. | |

| I respond to every email requesting updated information on my accounts | “Phishing” emails may look like official emails from real organizations, but the intent is to steal information from you. Do not reply with the requested information or follow links requiring you to login. Instead call the security department of the company that is supposed to have sent the email. | |

| I pay with a credit card at restaurants, letting the server take the card to process my payment. | Each time your credit card leaves your sight, it can be processed both for payment and run through a “skimming” device that captures card data, which can then be sold to identity thieves. Ask your server to bring the card reader to your table instead. | |

| If my wallet or purse were stolen or lost, I would be unsure of which cards were in there in order to report them missing. | As soon as you realize your wallet is gone, you must call your bank and the issuers of each missing debit and credit card. To make this easier, photocopy the front and back of every card you carry and keep the copies in a safe place—you’ll be ready to make your calls if you need to. | |

| I use my debit card to pay for store and online purchases. | Your debit card, while convenient, can provide easy access to your bank account. Limit your possible losses by taking extra care when using the card. Review your bank statements and report any unauthorized transactions (or a lost card) immediately | |

| When making a purchase online, I don’t care which website I buy from as long as they are selling the item I want. | Not every website is secure—think twice about providing your credit card and personal information when you’re online. Always read the website’s privacy and security policies and look for the “https” in the URL and closed padlock icon in the browser bar. |

|

|

I carry my Social Security card with me at all times. |

Do not carry your Social Security card unless it is needed for an official reason such as for a job hiring process or a visit to the Social Security office. At all other times, put your card in a safe place under lock and key | |

|

I never sign the back of my credit/debit cards. |

You may think you wouldn’t want a thief to know what your signature looks like, but you could actually be making things easier for a thief if you leave the card blank or only write “See I.D.” With no signature to match, a thief can simply sign however they want. Best to both sign and write “See I.D.” on your cards. | |

|

I carry my Medicare card with me at all times. |

Your Social Security number is on your Medicare card. If you’re visiting a new medical provider, carry the original, but otherwise carry a copy of your card, front and back, with the first six digits of your Social Security number blacked out. | |

|

When I’m asked for my Social Security number, I go head and give it. |

Many organizations ask for your Social Security number only because it is a convenient identifier, not because it’s needed for official reasons. Question every request; it is likely that the organization will be able to substitute a different number. | |

|

If I emptied my wallet/purse right now, I’m sure I would find some credit and/or debit cards that I rarely use. |

Remove all unused credit, debit, and other cards from your wallet—why provide a thief with more access? Carry only the items you actually use, and remember to record account numbers and issuer contact information in case these are lost. | |

|

If someone calls and asks for my personal identifying information, such as my Social Security number or credit card information, I’m likely to give it to them. |

If you did not initiate the call, do NOT give information out over the telephone. When you believe the organization is making a legitimate inquiry, ask for contact details and hang up. Always confirm the authenticity of a request before giving your information. | |

|

I use the same password or PIN for all of my accounts. |

While it may be easier to remember one password or PIN, it also compromises security across all of your password- and PIN-protected accounts. Use a different password for each account. Build strong passwords using eight digits or more and a variety of characters. | |

|

I carry my debit and credit card passwords and PINs in my wallet along with my cards. |

Purge your wallet of all references to passwords and PINs. If you cannot easily remember the most important ones, write them in a code only you will understand. Carefully protect any list you may keep of passwords and PINs, even at home. | |

|

If I receive an email or text message offering something I want for free, I respond. |

Don’t fall for email or text offers! Just clicking the links in an email that offers a reward or free item can install malicious software on your computer, enabling the sender to spy on you as you bank or shop online. Immediately delete the email—unopened—instead. | |

|

If I receive a letter from a business telling me there’s been a security breach and my account is involved, I figure that everything’s OK, and ignore it. |

A letter informing you of a possible security breach at an organization you do business with signals a need to request your credit reports right away. Always read the letter carefully and carry out any action steps it spells out. | |

|

When I go on vacation, I let the mail pile up in the mailbox. |

While you’re away, most of what you receive will be junk mail, but bank and credit card statements, letters from the IRS, or other official documents may also arrive. Instead of letting your mail pile up, request to have your mail held by the post office. |

|

|

I get my bank and credit card statements, but since I already know what I’ll see, I don’t really look at them. |

Statements received from financial institutions, medical providers, creditors, etc., will show every transaction in your account. Check your statements carefully. Follow up if you see a charge that you did not initiate. | |

|

My important papers are organized in a marked folder that I keep on/near my desk. |

While a handy, marked folder is convenient, it will also make your personal information an easy target for roommates, household employees, or service people. Instead, keep your personal information hidden, preferably under lock and key. | |

|

If you asked me around what date I get my bank statements, credit card bills and other financial communications each month, I wouldn’t really know. |

It’s important to know when bank and financial statements are likely to arrive each month so you can detect a problem early. Keep a list for a month or two to learn the dates. If an expected statement does not arrive, follow up and find out why. | |

|

When I receive a statement from a medical office or hospital, I take a quick look at it, but it’s usually too long to read very closely. |

Medical identity theft is on the rise, and if you do not check your statements—no matter how long they are—you may become a victim. Always make sure that the statements and claims match the care you received and follow up if you detect errors. | |

|

If I were to receive a collections call for a debt I never incurred, I’d just tell the caller they had the wrong number and hang-up. |

If you receive collections calls for debts you didn't incur, your identity may have been stolen. Don’t ignore these calls—they may be red flags. Instead, take action by requesting your credit reports and checking them very carefully. |

Have you learned some useful tips to protect your identity?

Pass this information on to family and friends. No matter a person’s age, anyone can benefit from the habit of protecting his or her identity information.

For more information visit or call 1-800-ASK-½ûÂþÌìÌÃ1 to get in contact with a ½ûÂþÌìÌà Extension office.

Status and Revision History

Published on Jan 07, 2015