A popular trend these days is for families to move from the city or a subdivision to a small tract of land in the country. Many people dream of owning a farm and undertaking an agricultural practice, perhaps like their ancestors did many years ago. The idea of producing your own food in a clean, controlled environment is very appealing to some people. While dreams may be big, careful research and planning should be done prior to jumping into any farm venture. Important considerations such as desire, capital, feasibility, labor, demographics, and marketing all need to be considered. If all of the items mentioned in the previous sentence can be checked off, then starting your mini farm may be a great experience.

How Much Land Do I Need?

The farm venture you are interested in may dictate how much land you’ll need. In some cases, a decent income can be realized from as little as half an acre of land if you are doing something like greenhouse plant production. Other enterprises, such as pine straw production, beef cattle, or Christmas trees will take considerably more acreage. While it is possible to generate enough income through farming 20 to 40 acres, in most cases folks approach this as a part-time venture. It is much better to select an income-producing idea that you enjoy and want to do even if no profit is realized.

Insurance, Licenses, Zoning, and Taxes

Assuming that you already have the land, any new business proposition should start with a solid business plan. Thought should be given to the amount of capital on hand and any potential legal issues. Make sure that the type of farming you are considering is allowed under the zoning of your residence. While some zoning ordinances will allow planting of crops, they may not allow keeping livestock.

Insurance also is important to take into consideration. If you plan to have customers on-site, such as a you-pick operation, you definitely will want to have liability insurance. You can never be too safe these days. Discuss liability coverage with your insurance agent and ask about what extra insurance might be needed to protect your farming equipment and other assets.

License requirements will depend on the type of business you plan to have. Anything that involves prepared food such as jellies, pies, or bread will require a cottage food license. This license is available through the . Counties may also require a business license or have other requirements, so it is important to check with your local government.

Living in the world we do today, it is nearly impossible to avoid taxes. Income realized from your farming venture needs to be reported on your taxes. Many people are under the false impression that buying a few acres and sticking a cow on the land will give them huge deductions on their taxes. While it is true that there may be several farm-related deductions available, they will not cover the expenses involved in your business. It’s a good idea to find an accountant that is well-versed in farm-related tax issues. If you have 10 or more acres of contiguous undeveloped property, applying for a Conservation Use Valuation Assessment (CUVA) program is perhaps one of the most convenient tax avenues to take advantage of. If your land qualifies, you can enter into a 10-year covenant pledging not to develop the land in exchange for property-tax assessments based on the land’s productivity, not its fair market value. This can save you a substantial amount of money on your property taxes. Check with your local tax office for details.

Labor Considerations

While some smaller operations may be handled by the owner and perhaps their spouse, other situations may involve hiring labor. Vegetable operations covering more than a couple of acres can be extremely time-consuming, and it’s often necessary to hire help to handle the numerous tasks. It might be valuable to check with an attorney specializing in labor laws to make sure you know what is involved in hiring someone to work on your farm. Hired employees can range from independent contractors to fully benefited staff. Finding and keeping good workers in any farming enterprise is usually one of the most difficult things small producers deal with. Hiring temporary migrant workers comes with a whole other set of rules and regulations that should be investigated thoroughly.

Government Program Assistance

Depending on the type of farming you intend to get into, there may be some financial help in the form of governmental assistance. Several programs have been offered that assist new, smaller farming operations in getting started. Sometimes these programs are set up on cost-shares, which require the producer to self-fund some of the money. Programs are sometimes available to help with the purchase of equipment, structures, fencing, and other farm-related expenses. Many of these programs have specific qualification requirements. There are programs that assist veterans or underserved minorities, too. For possible funding assistance, check with agencies such as (NRCS), , (FSA), and the . The NRCS, Georgia Forestry, and your local county Extension office are good sources of information for technical assistance with farming-like ventures.

Advertising and Marketing

Regardless of what type of product you are producing, it’s imperative to find someone to purchase it. Before you ever start your business, you should research carefully to make sure that you can get your product sold. There is nothing worse than planting 20 acres of pumpkins and being stuck with them at the end of October. Advertising and marketing are important aspects of your business that focus on getting the word out about your product. Whether you set up at a farmers’ market or plan to attract clients to your property, explore different methods of letting them know what you have. Many producers have found success using social media to advertise. Others put small ads in local newspapers or distribute flyers. Once you get a base clientele established, word of mouth may become the best method of promoting your product.

Equipment

Depending on the venture, a considerable amount of your startup costs will be spent on equipment. For many small farm activities, a small- to mid-size tractor could be very helpful. From plowing ground to moving hay, tractors take a lot of the burden off our backs. A small utility tractor with 20 to 40 horsepower is about the right size for most small operations. Depending on whether you are buying new or used equipment, the price can range from $10,000 to $50,000. Each implement purchased to pull behind the tractor will increase your equipment cost by several hundred dollars. A front-end loader on the tractor will increase its cost, but it’s extremely handy to have in a small operation.

Depending on the business, other equipment can include hand tools, fencing, structures—such as greenhouses or garden sheds—and possibly refrigerated storage. Most farm-type operations also will need a good source of water. If you need to dig a new well, this can easily cost $6,000 to $10,000 or more.

Overview of Possible Farming Ventures

Vegetable and Fruit Market

“Locally grown produce” has become a popular term over the last decade or so. Consumers have become more interested in buying locally grown fruits and vegetables that have not been imported from other states or countries. This has created a strong demand for the small-market fruit and vegetable grower. While the potential to make a good profit exists, this is likely one of the most labor-intensive ventures you can go into.

It takes an incredible amount of effort to maintain a vegetable garden; even as small as 2 acres. Finding and hiring affordable and reliable labor is always one of the biggest challenges in this industry. There also is a steep learning curve in understanding how to successfully grow and market the many different types of fruits and vegetables desired by the public.

Some smaller farms may decide to grow their crop organically and enjoy the higher profit margin that comes with this type of growing. Any produce grown and sold as certified organic must be certified through the USDA National Organic Program. Growers must meet stringent requirements to grow their crops organically and they also pay a certification fee. The fertilizers and chemicals that you can use will be limited, so this method of farming is even more labor-intensive than conventionally grown produce.

Other growing programs such as Certified Naturally Grown are a little less intensive, but still follow organic practices. Besides having available land, a small-grower operation will have substantial upfront equipment costs. If no water source is available, a deep well may need to be dug, resulting in a substantial financial investment. Other equipment purchases could include a small farm tractor and implements, irrigation equipment, a high tunnel, and a small greenhouse. Many small operations start in this business but give up after a few years when they see how much labor is involved to produce the crops. Someone going into this business should have a strong desire to work outside in all weather conditions and truly enjoy producing their own fruits and vegetables.

Ornamental Nursery Production

Some may argue that the most profitable farming per square foot can be made from growing ornamental plants. A single greenhouse producing bedding plants can yield thousands of dollars in profit when done correctly. Container-grown ornamentals and in-ground ornamental tree plantings also can be profitable when marketed properly.

Similar to the fruit and vegetable venture, growing ornamentals of any kind is extremely labor-intensive. Greenhouses and plants must be checked every day and receive supplemental irrigation and fertilization. The grower must also keep a keen eye out for pests such as disease and insects.

The initial layout of capital for greenhouses or an in-the-ground operation are fairly steep. It may take several years before a profit is realized. Even smaller operations normally will require the hiring of some outside labor.

Before entering this market, be certain you have a solid plan for where you will sell your plants. The more successful ornamental operations are linked with larger retail stores that will sell their goods. This normally involves selling your plants at a cheaper wholesale price and allowing the retailer to mark them up. The most income for your product is realized when you can sell directly to the public. This includes on-site purchases, selling at farmers’ markets, or selling to landscape companies.

In this industry, growing the product is only half of the battle—marketing and competing with other growers is the other half. It is imperative to have a solid business plan and be flexible to adjust to current market demands.

Christmas Trees

Producing Christmas trees on a small plot of land may seem like an easy and profitable enterprise for the small grower. Watching cut trees leave your property at a price between $25–$75 or more looks like easy money. But as the old saying goes, “If it was that easy, everyone would be doing it.”

The number one consideration before entering into the Christmas tree growing business is location. It can’t be emphasized enough that location is everything when it comes to growing Christmas trees. If your location is not visible or easy to get to, it will be difficult to market trees and make a profit. Most people don’t realize that growing Christmas trees is very labor-intensive. You don’t just stick a tree in the ground and collect a profit in 5 years. You will need to handle ground preparation, fertility, weed control, frequent pruning, and disease and insect prevention in order to bring your trees to market size.

Since Christmas tree sales are seasonal, this would be considered a part-time income stream rather than a year-round capital producer. If you have an excellent location and don’t mind some hard labor, growing Christmas trees can be a fun and profitable way to utilize some of your small acreage. Most growers start with a few acres at a time and increase acreage every year so that they have multiple ages of trees. Since Christmas trees can take at least 4 years before they are marketable, no income will be seen for at least that period of time. If you are interested in this type of farming, contact the . They have helpful information and can provide assistance to get you started.

Pine Straw Production

Perhaps one overlooked source of income for landowners with a lot of pine trees—or for those who are looking to plant them—is pine straw production. While you won’t get rich on producing pine straw on small acreage, it could produce a nice supplemental income to help offset the cost of your land and taxes.

Not all forested land is suitable for pine straw production. Landowners need to have a clean forest floor that is planted primarily in loblolly pine, slash pine, or longleaf pine. Out of these three, longleaf pines produce the best pine straw and the highest profit per bale.

The amount of pine straw that can be produced in an area depends on the stand density and the age of the trees. Pine straw harvest normally starts when trees are 6 to 10 years old and typically concludes after trees reach 15 to 20 years old.

More profit is realized when the landowner can directly sell to the consumer. Wholesale prices for pine straw sold to a retailer range from $0.30 to $1 per bale. Direct marketing to the consumer is preferred when possible.

A number of stand characteristics determine the sustainability of pine straw harvesting. Pine straw can be collected from both natural stands and plantations. It frequently is collected from plantations where evenly spaced trees facilitate mechanical gathering, in which needles are collected and bundled using a tractor-powered baler. Pine straw harvesting in natural stands is often done by hand-raking and by using a simple box baler. Because hand harvesters can maneuver between trees more easily than equipment can, there may be fewer preparations involved than if the site is a mechanically harvested plantation. While not as labor-intensive as some ventures, the landowner must provide maintenance, including the application of fertilizer and herbicides. Hand-raking straw and baling is another tiring task that may require additional labor.

Other possible ideas for small landowners

Mushroom Production

Edible mushrooms are in high demand from restaurants and consumers. Under the right conditions, they are not difficult to grow but require a lot of preparation and oversight.

On a very small scale, different edible mushrooms often are grown on 4–6 ft sections of cut logs. Larger scale mushroom producers use specialized grower houses for increased production. Mushroom producers should purchase certified edible mushroom spores from a reliable source.

Do not attempt to harvest, sell, or consume wild mushrooms that grow on your property. Wild mushroom identification is extremely difficult and poisonous mushrooms can easily be confused with edible ones.

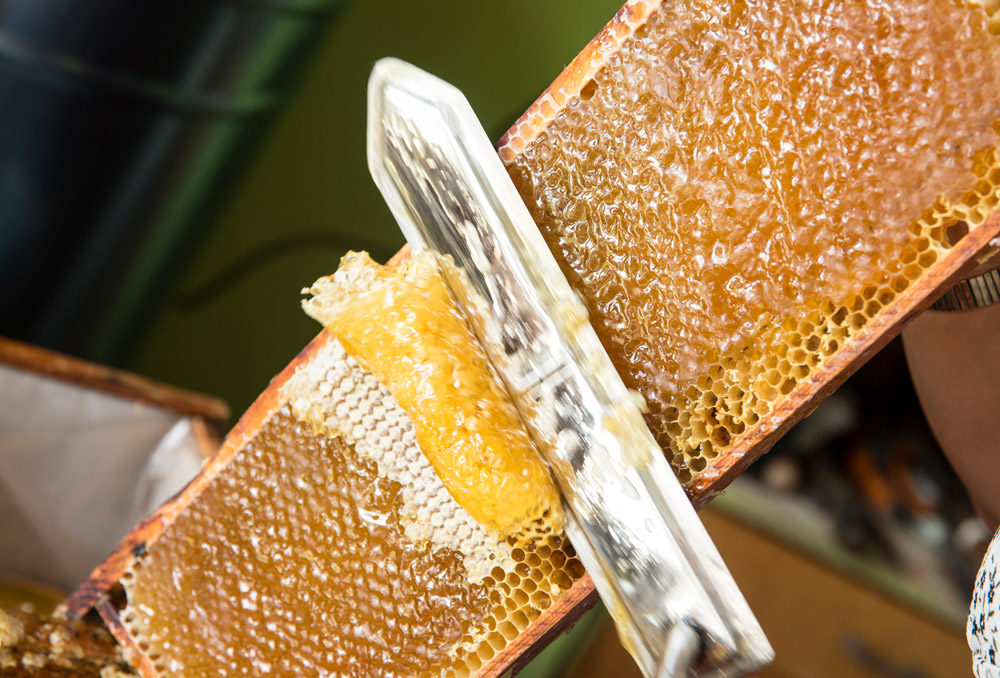

Honey Production

Honey production and beekeeping is a fascinating hobby that provides the landowner with several benefits. The honey produced by the bees can be collected and enjoyed at home or sold for profit. Bees also provide an outstanding pollination service to nearby fruits and vegetables.

While some costs can be recovered through the sale of honey or pollination services, this enterprise should be done more as a hobby, as the profit margin is small. Anyone interested in beekeeping should contact their local county Extension office for additional information. They may also be able to provide contacts for local beekeeping associations.

Livestock Production

On small acreage it can be very difficult to make a profit on any type of livestock production. The cost of fencing, structures, and feed usually make it impractical to try to raise beef, chickens, goats, or lambs for profit on a small scale.

Just as beekeeping is more of a hobby, livestock can be kept primarily to provide the landowners with freshly grown meat and eggs. It is possible to recover some money through the sale of meat from butchered animals or the sale of eggs. This is typically done by directly marketing the meat or eggs to the consumer.

Be sure to follow local zoning ordinances as well as USDA requirements. Keeping livestock can be a fun activity, particularly if children are involved.

Agritourism

Some small farm producers have found a unique way to make a profit through agritourism. Offering an assortment of farm activities and ventures may provide an opportunity to appeal to tourists. For example, having a you-pick strawberry field while also offering homemade strawberry ice cream may appeal to many visitors. Other producers have hosted school groups and churches for farm hayrides, pumpkin harvests, corn mazes, and farm-animal petting zoos. This type of farm business involves having a great location and excellent marketing. Liability insurance and accessible accommodations will need to be considered.

Status and Revision History

Published on Sep 19, 2023