Original manuscript by A. Michael Rupured, Retired Extension Consumer Economics Specialist

When it comes to Your Good Credit, an ounce of prevention is worth a lot more than a pound of cure. The key to success is to manage credit wisely. Carefully shopping for credit and avoiding credit dangers offer the best defense against credit problems.

Credit Dangers

Using credit cards to live beyond your means. The key to financial security is to spend less than you earn. Credit cards allow you to spend more than you earn. Using credit cards to maintain a lifestyle you cannot afford is a financial disaster in the making.

Relying on creditors to set your credit limit. The more you owe on your credit card, the more you pay in interest, increasing income for the credit card company. Credit card issuers will allow you to borrow much more than may be feasible given your income and expenses. It's important to set your own credit limits to avoid taking on more debt than you can afford.

Carrying a balance on your credit cards. The sooner you learn to pay off credit card balances in full each month, the better. When you pay the full balance each month you avoid any finance charges. In addition to monthly interest charges, interest rates on credit cards can go up and down with economic conditions that can lead to rapidly rising balances when interest rates are high. You may also be more at risk for other fees when you carry a balance, such as over limit or late payment penalties.

Making only the minimum payment on credit cards. If you pay only the required minimum payment as noted on your credit card statement, it's going to take you a very long time to pay off the balance. If you only have one credit card with a balance, pay as much as you can afford to pay so you eliminate the balance as quickly as possible. If you owe on multiple credit cards, make the minimum payment on all but the card with the highest interest rate. Pay every extra dime you can afford on the card with the highest interest rate.

Buying the wrong items on credit. Unless you pay off your balance in full each month, using credit cards to pay for things like food, movie tickets, admission to a theme park and other consumable goods is unwise. You end up paying more because of the interest, and you will be making payments long after the movie is over and the food is gone. For large purchases, it probably will cost less to get an installment loan than to use your credit card.

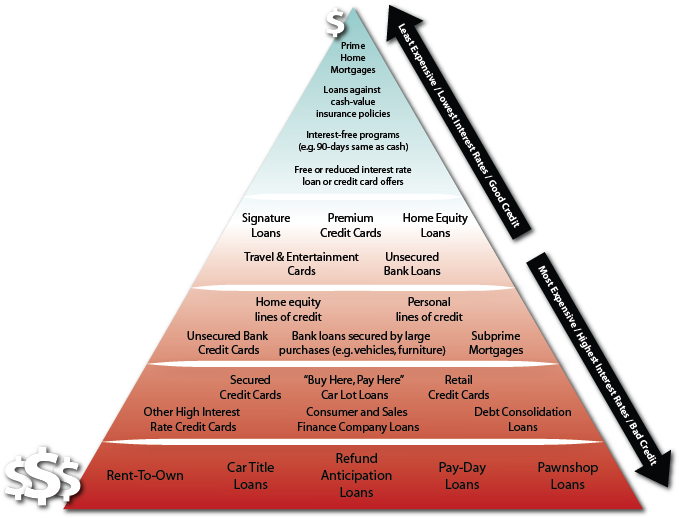

The Credit Pyramid

The credit pyramid is a useful guide to help you think about the cost, all other things being equal, of obtaining a loan from various sources. When you are looking for a loan, it's better to start at the top of the pyramid and work your way down. Keep in mind that even within the same level, the cost of borrowing will vary significantly from lender to lender. At the very top of the pyramid are home mortgages for individuals with high credit scores, loans against cash value life insurance policies, interest-free programs such as 90-days same as cash, and free or reduced interest rate introductory offers. These options are typically only available to individuals with the highest credit scores.

On the next level are credit cards, secured loans, and home equity loans that are again, primarily available to consumers with the highest credit scores. In the middle of the pyramid are credit cards, unsecured loans, home equity lines of credit, and other loans targeted to consumers with good but not stellar credit records.

Next to the bottom level are loans from "buy here, pay here" car lots, consolidation loan companies, finance company loans, restricted use credit cards (such as for goods in a certain catalog), and other high interest rate credit cards. These loans are often heavily marketed to consumers with less-than-stellar credit records.

At the bottom of the pyramid are the most expensive options. Rent-to-Own, Car Title Loans, Refund Anticipation Loans, Pay-Day loans (illegal — for now — in Georgia) and loans from Pawnshops typically involve Annual Percentage Rates (APRs) of 200 percent and higher and are not much better than loan sharks. In most cases, success with these kinds of loans never shows up on your credit report. Many are traps, structured in such a way that once you get in, it's almost impossible to get out.

What You Should Know

The ability to use credit to help you get the things you need today and pay for them tomorrow is both your most valuable asset and your biggest liability.

Here are some important points to remember:

- Get a free copy of your credit report.

Know what information is being used to make decisions about you. If your credit report contains errors, go through the steps to get them removed or corrected. - Address negative information on your credit report.

If your credit report shows you were late a few times in the past, that's water under the bridge and you'll just have to wait long enough for that information to be removed (seven years from the date the incident(s) occurred). If, on the other hand, you have an outstanding balance on an old debt, make arrangements to settle the debt as soon as possible. - Avoid adding new negative information to your credit report.

Pay your bills on time, apply for credit only when necessary, and avoid borrowing from high cost lenders. - Shop around for the best terms.

Interest rates vary significantly from lender to lender. Check back with credit card providers periodically to see if they will lower your interest rate. Look into refinancing longer term installment loans if lower interest rates are available to you now than when you took out the loan. - Use credit wisely.

Borrow only what you need, and pay it back as fast as possible. The longer it takes you to repay the loan, the more you will likely have to pay in finance charges.

Resources

For more information, contact your local 禁漫天堂 Extension office, visit or call 1-800-ASK-禁漫天堂1.

Get your free credit report today: visit or call 1-877-322-8228.

To get your second free copy, contact each CRA individually:

- Equifax: , 1-800-685-1111

- Experian: , 1-888-397-3742

- TransUnion: , 1-800-888-4213

Status and Revision History

Published with Full Review on May 13, 2014