The Agricultural Act of 2018 (2018 U.S. Farm Bill) extended the nonrecourse marketing assistance loan (MAL, hereafter simply referred to as “the loan”) and loan deficiency payment (LDP) feature for the 2019 through 2023 crop years for upland cotton.

The loan provides producers interim financing at harvest to meet cash flow needs without having to sell their commodities at harvest, when market prices are typically lower. It allows producers to store their production at harvest and provides opportunities to market the commodities throughout the year. On April 9, 2020, the U.S. Department of Agriculture (USDA) extended the loan repayment period from nine to 12 months for the 2018, 2019, and 2020 crops.

An LDP is a payment issued to producers for the harvested commodities when the government-determined market value is below the loan rate. Producers who take the LDP must forgo their option of putting the commodity into the loan. The LDP rate is the difference between the base loan rate and the government determined market value for the applicable commodity. For upland cotton, LDP payment rates are nonzero when the USDA-calculated weekly adjusted world price (AWP) of upland cotton is below the base quality loan rate. (The weekly AWP is derived from the daily CotLook A Index, which is commonly considered to be the index of world cotton prices. The USDA refers to the CotLook A Index as the Far East (FE) price. The USDA determines the weekly AWP based on the average of the daily A Index for the week beginning on a Friday and ending the following Thursday.)

Producers using these two programs must own the beneficial interest of the crop when putting upland cotton in the loan or when applying for the LDP. Beneficial interest specifically implies that a producer remains in control of the commodity, faces the risk of loss, and holds the title to the commodity. A detailed discussion about the MAL and LDP feature can be found in Liu, Bhattarai, and Robinson (2020) for upland cotton and Liu, Bhattarai, and Welch (2020) for other row crops in Georgia. This paper sheds light on how a producer can use the loan program and LDP feature to mitigate price risk for upland cotton.

In practice, many producers tend to use a two-step marketing process when using the actual loan program or LDP feature. In the first step, the producer decides whether to a) put upland cotton in the loan, or b) sell upland cotton outside of the loan and apply for an LDP, when available. If a producer chooses to put upland cotton in the loan, then the second step involves deciding to either forfeit the upland cotton to USDA or redeem the upland cotton from the loan and sell it. We will discuss these choices under the following two circumstances:

- AWP higher than the loan rate

- AWP lower than the loan rate

AWP is higher than the loan rate

When the AWP for upland cotton is higher than the base quality loan rate, an individual producer’s practical choices are to sell upland cotton outside the loan with no LDP or put upland cotton in the loan. It should be noted that producers who enroll their upland cotton in a marketing pool are effectively giving the pool responsibility for making those two choices. The following illustrates an example of the different options producers have and the net returns for each option.

Example 1: AWP is higher than the loan rate

Assume the current spot cash price for upland cotton is $0.74 per pound, the loan rate is $0.52 per pound, the interest charge for the loan is $0.01 per pound per month, the storage cost is $0.01 per pound per month, and the upland cotton price in the spot market increased to $0.80 per pound a month later.

Option 1: Sell the upland cotton now in the spot market. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Sales Price | + 0.74 |

| Net Return | = 0.74 |

Option 2: Sell the upland cotton in a month in the spot market without putting the upland cotton in the loan. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Sales Price | + 0.80 |

| 1 Month Storage Cost | - 0.01 |

| Net Return | = 0.79 |

Option 3: Put the upland cotton in the loan now and then redeem and sell the upland cotton in the spot market a month later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Loan Rate (Borrowed) | + 0.52 |

| Loan Rate (Repaid) | - 0.52 |

| Accrued Interest | - 0.01 |

| 1 Month Storage Cost | - 0.01 |

| Sales Price | + 0.80 |

| Net Return | 0.78 |

Option 4: Put the upland cotton in the loan now and forfeit the loan at the end of the loan period. The net return will be at the loan rate of $0.52 per pound. A producer can get a higher return to take the the upland cotton out of the loan than forfeit. For this reason, it would be impractical for producers to use this option when the AWP and market price is higher than the loan rate.

In example 1, we illustrate the circumstance that the price increases a month later. Because the increase in price is higher than the storage cost, the producer benefits from waiting a month to sell the upland cotton. However, if the price decreases or the price increase is lower than the storage cost, the producer will lose money by selling later. Thus, producers are exposed to one month of price risk in option 2 and 3 (above the loan rate) but are not exposed to price risk with option 1. For substantial price declines, specifically below the loan rate, the outcomes are different and require further consideration.

When the AWP is higher than the loan rate, the producer pays additional interest costs at the redemption of the loan (option 3). The interest costs charged to producers at redemption reduce the net return for producers who use option 3 compared to the net return of using option 2. However, by putting the upland cotton in the loan, the loan program lends money to cotton producers up front at the loan rate for each pound of upland cotton. The need for cash flow upon harvest, including paying off their operating loans, is the primary reason why producers put the upland cotton into the loan. For the producers who need the immediate cash flow to pay back their operating loans, the interest cost of keeping the upland cotton in the loan (option 3) may be a trade-off with the interest cost on an operating loan. Putting the upland cotton in the loan is a good option for them since the interest is lower than an operating loan. However, it may not be optimal for a cotton producer to use the commodity loan program if the producer does not need the immediate cash flow.

AWP is lower than the loan rate

When the AWP for upland cotton is lower than the base quality loan rate, the producer can either put upland cotton in the loan or forgo the loan and apply for the LDP. At low commodity prices, producers can receive marketing loan benefits in the form of marketing loan gains (MLGs), LDPs, commodity certificate exchange gains, and forfeiture gains. Commodity loan programs protect the minimum price received by producers from dropping even further below the loan rate during a period of low commodity prices. Growers have three alternatives to use commodity loan programs to mitigate their marketing risks. These alternatives include:

Alternative 1: Forward contract to fix cash price for upland cotton while maintaining the beneficial interest of the crop and apply for the LDP.

Alternative 2: Apply for the LDP while maintaining the beneficial interest of the crop and then sell the harvested upland cotton in the spot market.

Alternative 3: Put the upland cotton in the loan, essentially for the storage benefit, and redeem it out of the loan at a later date.

If the upland cotton is under contract and never intended to be put in the loan in the first place, a producer can use alternative 1 to get more money in addition to the contracted price. Alternative 1 offers the producer the least price risk among all three alternatives, especially if the producer can use a forward contract and fix the price above their production costs. If a producer does not have a forward contract for their upland cotton, the producer can use alternative 2 or alternative 3 to mitigate downside price risk. Alternatives 2 and 3 embody the government safety net program to ensure the minimum price target. These alternatives provide a similar amount of marketing loan benefits to producers. However, based on expected and realized price changes in some situations, using one option, a producer might be able to get a slightly better outcome than the other one. We will use examples 2 through 4 below to help growers better understand the options between alternatives 2 and 3.

Example 2: AWP is lower than the loan rate and decreases in the future.

Assume the current AWP is $0.46 per pound, the loan rate is $0.52 per pound, the interest charge for the loan is $0.01 per pound per month, the storage cost is $0.01 per pound per month, and the future AWP decreases to $0.42 per pound.

Situation 1: Additional assumption: Assume the current upland cotton price in the spot market is $0.46 per pound and the producer decided to sell upland cotton now after applying for the LDP. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.46 |

| Net Return | = 0.52 |

Situation 2: Additional assumption: Assume the current upland cotton price in the spot market is $0.48 per pound and the producer decided to sell upland cotton now after applying for the LDP. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.46 |

| Net Return | = 0.52 |

Situation 3: Additional assumption: Assume the current upland cotton price in the spot market is $0.44 per pound and the producer decided to sell upland cotton now after applying for the LDP. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.44 |

| Net Return | = 0.50 |

Situation 4: Additional assumption: Assume the producer decides to store the upland cotton and sell it a month later, the current upland cotton price in the spot market is $0.46 per pound, and the upland cotton price in the spot market decreased to $0.42 per pound a month later.

Option 1: Apply for the LDP now and then sell the upland cotton in the spot market a month later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.42 |

| 1-Month Storage Cost | - 0.01 |

| Net Return | = 0.47 |

Option 2: Put the upland cotton in the loan now and then redeem and sell the upland cotton in the spot market a month later.* The MLG is $0.10 ($0.52 - $0.42 = $0.10) per pound. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Loan Rate (Borrowed) | + 0.52 |

| AWP a Month Later (Alternative Loan Repayment Rate) | - 0.42 |

| Sales Price | + 0.42 |

| Net Return | = 0.52 |

Situation 5: Additional assumption: Assume the producer decides to store the upland cotton and sell it 9 months later, the current upland cotton price in the spot market is $0.46 per pound, and the upland cotton price in the spot market decreased to $0.42 per pound 9 months later.

Option 1: Apply for the LDP now and then sell the upland cotton in the spot market 9 months later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.42 |

| 9-Month Storage Cost | - 0.09 |

| Net Return | = 0.39 |

Option 2: Put the upland cotton in the loan now and then redeem and sell the upland cotton in the spot market 9 months later. The MLG is $0.10 ($0.52 - $0.42 = $0.10) per pound. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Loan Rate (Borrowed) | + 0.52 |

| AWP 9 Month Later (Alternative Loan Repayment Rate) | - 0.42 |

| Sales Price | + 0.42 |

| Net Return | = 0.52 |

Option 3: Put the upland cotton in the loan now and forfeit the loan at the end of the loan period.* The net return will be at the loan rate of $0.52 per pound. The forfeiture gain is $0.10 ($0.52 - $0.42 = $0.10) per pound.

*Note. If a producer forfeits the upland cotton, the producer may be responsible for some charges including warehouse receiving/compression charges. Producers are encouraged to contact their local Farm Service Agency office for more information related to the charges associated with forfeiting their upland cotton.

Example 2 illustrates five different situations where the current AWP is lower than the loan rate and the upland cotton prices decrease in the future. Situations 1-3 illustrate producers selling their upland cotton after applying for the LDP. In situation 1, because the upland cotton is sold at the same price as the AWP, the net return for the producer is equal to the loan rate. In situation 2, the upland cotton is sold higher than the AWP and thus the net return is higher than the loan rate. In situation 3, the upland cotton is sold lower than the AWP and the producer will receive a net price lower than the loan rate. Situations 4 and 5 illustrate the circumstances when the upland cotton price decreases in the future. In situations 4 and 5, we assume that the sales price for the upland cotton is the same as the AWP at that time. Thus, using option 2, the net return for the producer is the same as the loan rate. If the producer sells the upland cotton above the AWP using option 2, then the net return for the producer will be above the loan rate and vice versa.

Example 2 shows that if taking the LDP, there is no further protection from prices going further below the loan rate. If the producer opts to take the LDP and forgo putting their upland cotton in the loan to minimize the loss, the producer should be prepared to sell their upland cotton as soon as possible (situations 1-3). If the producer chooses to store the upland cotton while upland cotton prices continue to decrease (situations 4 and 5), the loan alternative (option 2) will be a better option to mitigate the risk compared to applying for the LDP (option 1).

When the AWP is lower than the loan rate, a producer can pay back the loan at the AWP. That is, any accrued interest charges for the loan are waived and partial storage charges during the loan period can also be waived. Subsidized storage costs also make upland cotton in the loan more attractive to merchants. Thus, buyers who acquire a producer’s upland cotton in the loan (through preplant marketing pool contracts or post-harvest equity contracts) benefit from sub-loan rate upland cotton prices because of the partial or full coverage of the storage costs by the loan program.

Therefore, when the AWP is below the loan rate, if a producer chooses to take the LDP and opt out of the loan, the producer may get lower bids for their upland cotton with the LDP than upland cotton in the loan. The reduction in upland cotton prices and the extra storage costs incurred reduce the net return for a producer using the LDP. Further tumbling in upland cotton prices is the major price risk that upland cotton producers face after applying for the LDP.

Example 3: AWP increases in the future but is still below the loan rate.

Assume the current AWP is $0.46 per pound, the loan rate is $0.52 per pound, the interest charge for the loan is $0.01 per pound per month, the storage cost is $0.01 per pound per month, and the AWP in the future increases to $0.50 per pound.

Situation 1: Additional assumption: Assume the producer decides to store the upland cotton and sell it a month later, the current upland cotton price in the spot market is $0.46 per pound, and the upland cotton price in the spot market increased to $0.50 per pound a month later.

Option 1: Apply for the LDP now and then sell the upland cotton in the spot market a month later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.50 |

| 1-Month Storage Cost | - 0.01 |

| Net Return | = 0.55 |

Option 2: Put the upland cotton in the loan now and then redeem and sell the upland cotton in the spot market a month later. The MLG is $0.02 ($0.52 - $0.50 = $0.02) per pound. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Loan Rate (Borrowed) | + 0.52 |

| AWP (Alternative Loan Repayment Rate) | - 0.50 |

| Sales Price | + 0.50 |

| Net Return | = 0.52 |

Situation 2: Additional assumption: Assume the producer decides to store the upland cotton and sell it 9 months later, the current upland cotton price in the spot market is $0.46 per pound, and the upland cotton price in the spot market increased to $0.50 per pound 9 months later.

Option 1: Apply for the LDP now and then sell the upland cotton in the spot market 9 months later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.50 |

| 9-Month Storage Cost | - 0.09 |

| Net Return | = 0.47 |

Option 2: Put the upland cotton in the loan now and then redeem and sell the upland cotton in the spot market 9 months later. The MLG is $0.02 ($0.52 - $0.50 = $0.02) per pound. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Loan Rate (Borrowed) | + 0.52 |

| AWP (Alternative Loan Repayment Rate) | + 0.50 |

| Sales Price | - 0.50 |

| Net Return | = 0.52 |

Option 3: Put the upland cotton in the loan now and forfeit the loan at the end of the loan period. The net return will be at the loan rate of $0.52 per pound. The forfeiture gain is $0.02 ($0.52 - $0.50 = $0.02) per pound.

Example 3 illustrates two different situations where the current AWP is lower than the loan rate and the AWP increases in the future but is still below the loan rate. In situation 1, the spot market price increases a month later and the increase in price is higher than the storage costs. Producers who take the LDP and then sell the upland cotton in the spot market later (option 1) have a higher return than producers who put the upland cotton in the loan. In situation 2, the spot market price increases 9 months later. Because the increase in upland cotton prices is lower than the storage costs, producers using this option end up with a lower net return.

Example 3 shows that if the price increases quickly and the increase in price is higher than the storage costs, then it would be beneficial to take the LDP and sell the upland cotton in the spot market later. If the producer anticipates that it might take a long time before the price recovers, then the producer should consider putting the upland cotton in the loan, which can provide storage credits for the producer when the AWP is below the loan rate.

Example 4: AWP increases in the future to be higher than the loan rate.

Assume the current AWP is $0.46 per pound, the loan rate is $0.52 per pound, the interest charge for the loan is $0.01 per pound per month, the storage cost is $0.01 per pound per month, and the AWP in the future increases to $0.65 per pound.

Situation 1: Additional assumption: Assume the producer decides to store the upland cotton and sell it a month later, the current upland cotton price in the spot market is $0.46 per pound, and the upland cotton price in the spot market increased to $0.65 per pound a month later.

Option 1: Apply for the LDP now and then sell the upland cotton in the spot market a month later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.65 |

| 1-Month Storage Cost | - 0.01 |

| Net Return | = 0.70 |

Option 2: Put the upland cotton in the loan now and then redeem and sell the upland cotton in the spot market a month later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Loan Rate (Borrowed) | + 0.52 |

| Loan Rate (Repaid) | - 0.52 |

| 1-Month Accrued Interest | - 0.01 |

| 1-Month Storage Costs | - 0.01 |

| Sales Price | + 0.65 |

| Net Return | = 0.63 |

Situation 2: Additional assumption: Assume the producer decides to store the upland cotton and sell it 9 months later, the current upland cotton price in the spot market is $0.46 per pound, and the upland cotton price in the spot market increased to $0.65 per pound 9 months later.

Option 1: Apply for the LDP now and then sell the upland cotton in the spot market 9 months later. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| LDP | + 0.06 |

| Sales Price | + 0.65 |

| 9-Month Storage Cost | - 0.09 |

| Net Return | = 0.62 |

Option 2: Put the upland cotton in the loan now, redeem and sell the upland cotton in the spot market 9 months later. Using this option, a producer gets a lower return than the forfeiture of the crop at the loan rate, so it is in the best interest of the producer to forfeit instead of redeeming the crop. The result of the net return is listed in the table below.

| Price Per Pound ($) | |

|---|---|

| Loan Rate (Borrowed) | + 0.52 |

| Loan Rate (Repaid) | - 0.52 |

| 9-Month Accrued Interest | - 0.09 |

| 9-Month Storage Costs | - 0.09 |

| Sales Price | + 0.65 |

| Net Return | = 0.47 |

Option 3: Put the upland cotton in the loan now and forfeit the loan at the end of the loan period. The net return will be at the loan rate of $0.52 per pound.

Example 4 illustrates two different situations where the current AWP is lower than the loan rate and the AWP increases in the future above the loan rate. For option 1, because the increase in the upland cotton prices is higher than the storage costs, producers using this option end up with a higher net return. For option 2, because the AWP is higher than the loan rate, producers need to pay back the loan with additional interest costs. Also, when the AWP is above the loan rate, the merchant needs to pay the storage charges during the loan period, and the merchant tends to bid the upland cotton lower to cover the storage cost. Comparing option 1 with option 2, producers are able to get a higher net return using option 1 for the following two reasons: 1) Producers are able to claim the additional LDP payment, and 2) Producers using option 1 do not need to pay for the interest charge for the loan.

Example 4 shows that if the producer anticipates that the upland cotton prices will increase above the loan rate and the increase in prices will be higher than the storage costs, then it is beneficial for the producer to take the LDP and sell the upland cotton in the spot market at a later date. However, if the upland cotton price increases above the loan rate but the amount of the increase is lower than the storage costs, then the producer should apply for the LDP and sell the upland cotton immediately, or forfeit their upland cotton to the loan program.

Summary

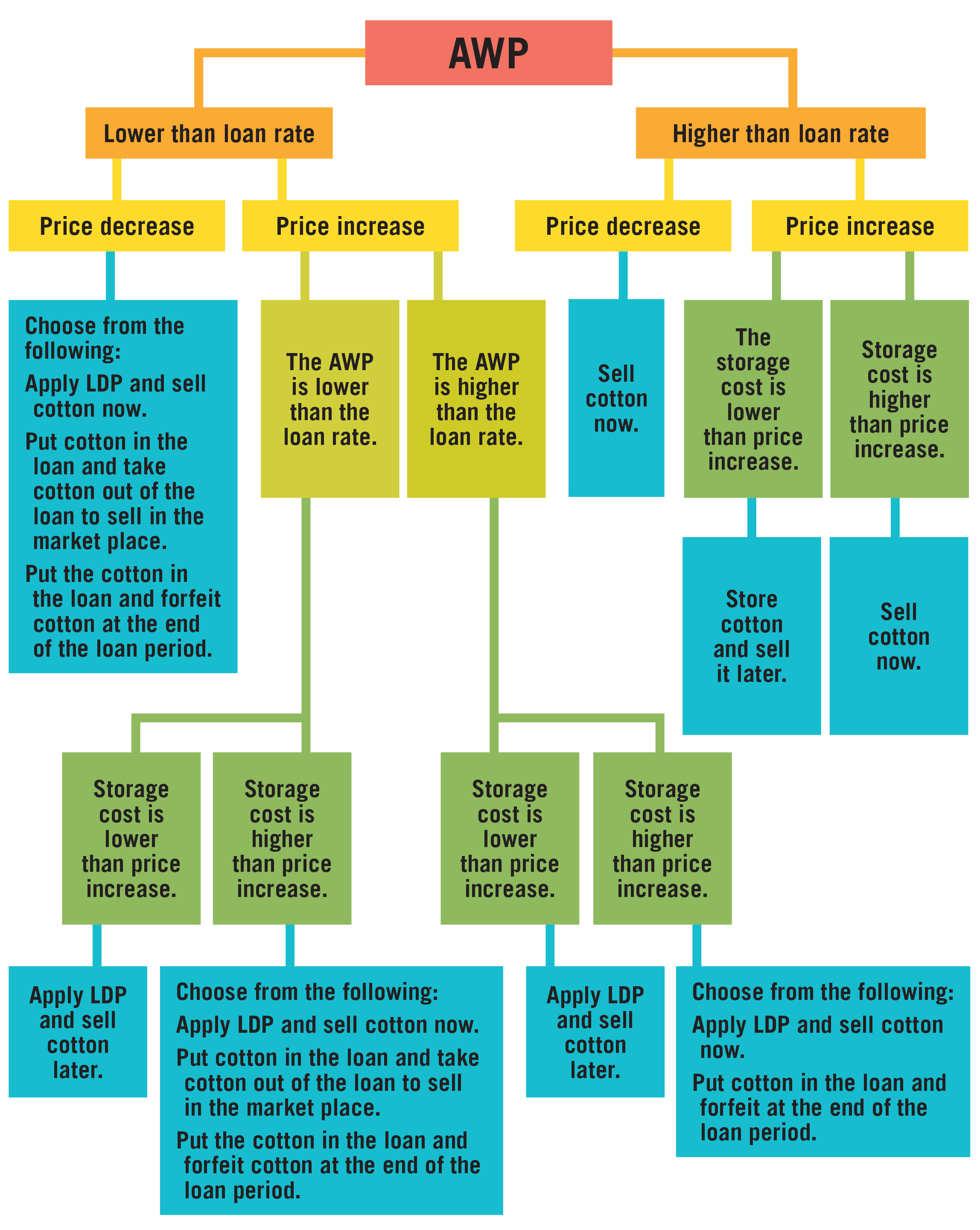

Figure 1 is a decision tree summarizing the choices for putting the upland cotton in the loan or applying for LDP. The decision-making process between the loan or LDP is dependent on the storage costs and the price expectations in the future, including the spot market price and the AWP. It is important for producers to formulate accurate future price expectations when considering the use and effectiveness of these risk management products. Applying for the LDP is a riskier move than putting the upland cotton in the loan. Applying for the LDP gives the upland cotton producers upside potential to get a net return higher than the loan rate when the increase in sales price is higher than the storage costs. However, when prices drop, applying for the LDP and marketing the upland cotton later results in higher downside price risk for producers than putting the upland cotton in the loan. When the producer takes the LDP, there is no further protection from prices going even lower below the loan rate, and they also incur storage costs, which may reduce the final bid for the crop from a merchant. Producers who take the LDP should be prepared to sell their upland cotton quickly or consider other alternatives to manage the downside price risk. If a producer is willing to take the risk and thinks that upland cotton prices are going to improve in the short term, then the producer could take the LDP and eventually sell their upland cotton.

The producer who wants to apply for the LDP should monitor the market closely for the highest weekly LDP rate. The producer also needs to own the beneficial interest of their upland cotton and make sure that any forward contracts or cash sales do not disqualify them from applying for the LDP. In general, a producer must retain the beneficial interest in the commodity until the paperwork is submitted to claim the LDP. Once the producer has submitted all required forms, the producer is free to transfer the title of the upland cotton.

If the producer believes that prices are not going to improve in the near term and they need to store their upland cotton to wait for a better price, the producer could use the MAL program and put their upland cotton into the loan. Storage and interest costs can be waived under the loan if the AWP is below the loan rate at redemption. Producers eliminate the downside risk when prices drop further by putting the upland cotton in the loan. An upland cotton producer is guaranteed to receive the minimum price at the loan rate when putting the upland cotton in the loan program.

However, when prices increase, producers who put the upland cotton in the loan have less upward potential than producers who apply for the LDP. Thus, the decision between putting upland cotton in the loan and applying for the LDP relies upon the producer’s risk preference. Past history and experience show that if the LDP is available, producers frequently opt to take the LDP and forgo putting their upland cotton in the loan.

References

Liu, Y., Bhattarai, A., & Welch, J. M. (2020). Understanding the commodity loan programs for major row crops in Georgia. Department of Agricultural and Applied Economics, University of Georgia. Report No. AGECON-20-02PR. March 2020.

Liu, Y., Bhattarai, A., & Robinson, J. R. C. (2020). Marketing assistance loan and loan deficiency payment program for upland cotton. University of Georgia Cooperative Extension Circular 1194. /publications/detail.html?number=C1194

Status and Revision History

Published on Nov 06, 2020

Published with Full Review on Apr 21, 2023