Starting in 2018, the Trump Administration announced significant changes in tariff actions on a variety of imports to the United States, which led to retaliation by U.S. trading partners including China and many U.S. allies. Tariffs are taxes or duties that a government charges on goods coming into or going out of their country. Import tariffs are taxes charged to imported products. Along with the Section 301 of the Trade Act of 1974 investigation into China’s practices related to technology transfer, intellectual property, and innovation, several additional investigations were conducted involving Section 201 of the Trade Act of 1974 (covering imported solar cells and modules and imported washing machines) and Section 232 of the Trade Expansion Act of 1962 (concerning imported steel and aluminum). In addition, the Trump Administration implemented measures to tighten Chinese-based semiconductor and telecommunications companies’ (ZTE and Huawei) access to the U.S. market to safeguard its own semiconductor industry (Bown & Kolb, 2021).

These actions led to a 2-year trade dispute between the United States and China. Global commercial ties were destabilized, while trade and investment transactions were hampered by the resulting trade dispute. Research demonstrated that U.S. tariffs on imported Chinese intermediate products resulted in increased production costs for U.S. firms using Chinese imports in their supply chains (Flaaen & Pierce, 2019). Other research found that U.S. consumers and companies bore nearly the entire increased cost associated with the tariffs, with some variation across sectors (CRS, 2020). In addition, the burden of tariffs falls more heavily on traded goods and the populations that purchase them. Studies generally find that tariffs harm low- and middle-income U.S. households more than high-income U.S. households, because low- and middle-income households spend more as a proportion of their total dispensable income on tradable goods (Furman et al., 2017).

On January 15, 2020, the United States and China signed the Phase One trade agreement, which eased trade tensions between the two countries. This paper documents the timeline of the U.S.–China trade dispute, and China’s retaliation and responses to Trump Administration tariffs. As cotton and related products were caught in the middle of the trade dispute, this paper also covers tariffs implemented by both countries on the cotton and textile sector

Effect of tariffs on solar panels and washing machines

The timeline for Chinese retaliatory tariffs on U.S. import tariffs on solar panels and washing machines, based on Section 201 of the Trade Act of 1974, is listed in Table 1. While the Chinese tariff on sorghum was not a stated retaliation to the Trump Administration’s tariffs on solar panels and washing machines, the coincidence of the timing suggests a retaliatory response from China.

Table 1. Timeline of Chinese and U.S. tariffs on imported solar panels and washing machines based on Section 201 of the Trade Act of 1974.

January 23, 2018: President Trump approved non-country-specific global safeguard tariffs under Section 201 of the Trade Act of 1974 on U.S. solar panel and washing machine imports.

February 7, 2018: Effective date of a 30% U.S. tariff on $8.5 billion worth of solar panel imports and a 20% U.S. tariff on $1.8 billion worth of imports of washing machines. At this time, most solar panel and washing machines came from China.

April 17, 2018: China announced preliminary anti-dumping duties of 178.6% on imports of U.S. sorghum, worth roughly $1 billion.

May 18, 2018: China ended the tariff on U.S. sorghum after negotiations were made to resolve trade disputes.

September 19, 2018: The United States announced a limited number of solar product exclusions.

February 7, 2020: The U.S. tariff-rate quotas (TRQs) allocation limit for large residential washers was changed to 1.2 million per quarter, to eliminate possible concentration of imports in a single quarter.

U.S. import restrictions: Restrictions on washing machine imports expired in February 2021; restrictions on solar products expired in February 2022; instead, the Biden Administration extended some restrictions. Solar cells: 4-year TRQ with 30% above quota tariff, descending 5% annually. Solar modules: 4-year 30% tariff, descending 5% annually. Large residential washers: 3-year TRQ, 20% in quota tariff descending 2% annually, 50% above quota tariff descending 5% annually. Large residential washer parts: 3-year TRQ, 50% above quota tariff, descending 5% annually.

Countries affected by U.S. Section 201 tariffs: Canada is excluded from the U.S. duties on washers. Certain developing countries are excluded if they account for less than 3% individually or 9% collectively of U.S. imports of solar cells or large residential washers, respectively. All other countries included.

Adapted from White House; USITC; CRS Report R45529; Bown & Kolb, 2021; Li et al., 2018.

Chinese retaliatory tariffs on U.S. import tariffs on steel and aluminum

The timeline for Chinese retaliatory tariffs on U.S. import tariffs of steel and aluminum, based on Section 232 of the Trade Expansion Act of 1962, is listed in Table 2. Notably, before the March 23, 2018, effective date, the European Union, South Korea, Brazil, Argentina, Australia, Canada, and Mexico temporarily were exempted from the steel and aluminum tariffs, while China was not (Bown & Kolb, 2021). This steel and aluminum tariff policy targeted $2.8 billion worth of Chinese products, based on 2017 import values (Lu & Schott, 2018).

Table 2. Timeline for China’s retaliatory tariffs on U.S. tariffs on imported steel and aluminum that were based on Section 232 of the Trade Expansion Act of 1962.

March 23, 2018: United States imposed 25% and 10% tariffs on all trading partners of steel and aluminum, respectively. Temporary exemptions were in place for certain countries until May 1, 2018 (later extended to June 1, 2018).

April 2, 2018: China suspended tariff reduction obligations and imposed retaliatory tariffs effective immediately on 128 products of U.S. origin, worth around $3 billion. Chinese tariffs affected roughly $2 billion worth of U.S. agricultural product exports to China on 84 products, ranging from a 25% tariff on pork to 15% tariff on fruits, nuts, wine, ginseng, and ethanol.

February 8, 2020: President Trump imposed 25% and 10% tariffs on derivative products of steel and aluminum, respectively.

U.S. import restrictions: Aluminum: 10% tariffs on certain aluminum and aluminum derivatives, effective indefinitely. Steel: 25% tariffs on certain steel and steel derivatives, effective indefinitely.

Countries affected by U.S. Section 201 tariffs: Aluminum: Argentina*, Australia, Canada, and Mexico exempted. All other countries included. Steel: Argentina*, Australia, Brazil*, Canada, Mexico, and South Korea* exempted. All other countries included.

*Quantitative import restrictions were imposed in place of tariffs.

From White House; Commerce Department; CRS, 2020; Bown & Kolb, 2021; Lu & Schott, 2018; Liu, Fonsah, et al., 2018; Liu, Robinson, & Shurley, 2018; Inouye, 2018.

Chinese retaliatory tariffs resulting from the United States’ investigation into unfair trade practices for technology and intellectual property

The U.S. Section 301 Trade Investigation of China regarding unfair practices related to technology transfer, intellectual property, and innovation went through multiple rounds of tariffs, and the friction intensified before the Phase One trade deal was signed on January 15, 2020. Even though the new U.S. tariffs on Chinese imports were announced and first implemented in 2018, the U.S. Section 301 investigations already were ongoing in early 2017, shortly after President Trump began his presidential term.

On March 22, 2018, the Trump Administration released an investigative report that expressed concerns about China’s practices related to technology transfer, intellectual property, and innovation under Section 301 of the Trade Act of 1974 (Office of the U.S. Trade Representative [USTR], 2018). Motivated by the lack of substantive progress in addressing some U.S. concerns, on April 3, 2018, the Trump Administration officially announced 25% tariffs on 1,333 Chinese products worth $50 billion, which led to China’s retaliatory tariffs and marked the start of the 2-year trade dispute between the two countries.

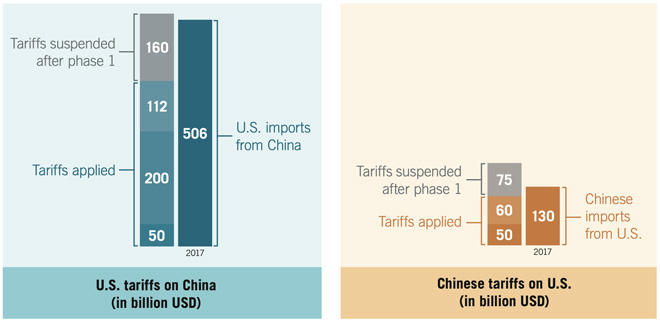

Figure 1 summarizes the value of imports affected by tariffs from each country (left-hand columns) and the total trade value between the United States and China in 2017 (right-hand columns) before the trade dispute started. As shown in this figure, at a certain point before signing the Phase One trade agreement, tariffs scheduled to be implemented by each country almost covered the two countries’ full trading value. The effective dates of tariffs implemented by both countries based on the U.S. Section 301 investigation are summarized in Figure 2. Table 3 shows the detailed timeline for the Chinese retaliatory tariffs resulting from the U.S. Section 301 investigation.

Figure 1. Comparison of U.S. tariffs on China and Chinese tariffs on the U.S.

The first panel shows a stacked bar of tariffs, with blocks of $50, 200, and 112 billion USD grouped as "Tariffs applied" and a $160 billion USD block labeled as "Tariffs suspended after phase 1." The next bar is slightly shorter and shows 2017 U.S. imports from China at $506 billion USD. The second panel shows a stacked bar of $50 and 60 billion USD grouped as "Tariffs applied" and a $75 billion USD block labeled "Tariffs suspended after phase 1." The next bar is slightly shorter and shows $130 billion USD labeled "Chinese imports from U.S."

From the U.S. Census Bureau and data collected from governmental news releases from the United States and China.

Timeline made up of blocks connected with arrows. The first block is Jul. 6, 2018: U.S. imposed 25% tariffs on $34 billion of Chinese products. China retaliated with 25% tariffs of $34 billion of U.S. products.

The next block is Aug. 23, 2018: U.S. imposed 25% tariffs on $16 billion of Chinese products. China retaliated with 25% tariffs on $16 billion of U.S. products.

The next block is Sep. 24, 2018: U.S. imposed 10% tariffs on $200 billion of Chinese products. China retaliated with 5% and 10% tariffs on $60 billion of U.S. products.

The next block is May 10, 2019: U.S. raised tariffs from 10% to 25% tariffs on $200 billion of Chinese products.

The next block is Jun. 1, 2019: China retaliated with a raise of tariffs to 5%, 10%, 20%, and 25% on $60 billion of U.S. products.

The next block is Sep. 1, 2019: U.S. imposed 15% tariffs on $112 billion of Chinese products. China retaliated with 5% and 10% tariffs on the first part of the $75 billion of U.S. products.

The next block is Dec. 13, 2019: U.S. suspended the scheduled December 15, 2019, tariff on $160 billion of Chinese products. China suspended the scheduled December 15, 2019, tariff on the second part of $75 billion of U.S. products.

The next block is Jan. 15, 2020: The U.S. and China signed the Phase One Trade Agreement.

The next block is Feb. 14, 2020: U.S. halved the September 1, 2019, tariffs on $112 billion of Chinese products. China halved the September 1, 2019, tariffs on the first part of $75 billion of U.S. products.

The last block is Mar. 2, 2020: China temporarily lifted the retaliatory tariff on 696 tariff lines of U.S. products. A large number of U.S. agricultural products were included.

Table 3. Timeline for China’s retaliatory tariffs resulting from U.S. tariffs that were based on Section 301 of the Trade Act of the 1974 regarding investigations into unfair trade practices for technology and intellectual property investigation.

April 3, 2018: The Trump Administration officially announced 25% tariffs on 1,333 Chinese products worth $50 billion.

April 4, 2018: China announced 25% retaliatory tariffs on 106 U.S. products worth $50 billion. Thirty-three products on the Chinese list were U.S. agricultural products worth approximately $16.5 billion.

June 15, 2018: The United States released a revised list of 1,102 Chinese products (worth $50 billion) to be charged a 25% tariff, which would be implemented in two stages: the first stage, on 818 Chinese products worth $34 billion, was effective on July 6, 2018.

June 16, 2018: China responded by issuing an updated $50 billion retaliation list with 25% tariffs on 659 U.S. products in two stages: the first-stage tariffs on 545 U.S. products worth $34 billion also was effective on July 6, 2018. The Chinese list was expanded from the proposed list announced by China on April 4, 2018. In the updated list, 517 U.S. products either were agricultural or related to agriculture.

June 18, 2018: In response to China’s retaliatory tariffs announced on June 16, 2018, President Trump directed the U.S. Trade Representative to identify an additional $200 billion worth of Chinese goods for additional tariffs, and also threatened tariffs on another $200 billion worth of goods if China retaliated further.

July 6, 2018: The Stage 1 tariffs both went in effect by the United States and China, covering $34 billion of goods traded for each country.

July 10, 2018: The U.S. list of $200 billion worth of imports from China was disclosed, with the clarification that a new 10% tariff rate would be imposed after public hearings.

August 1, 2018: President Trump directed the U.S. Trade Representative to consider a 25% tariff rate rather than the 10% rate on the list of $200 billion worth of imports released on July 10, 2018.

August 3, 2018: China announced its proposed supplemental tariffs of 5% to 25% on U.S. imports, covering $60 billion worth of products in retaliation to the August 1, 2018, U.S. tariff announcement. China stated that the proposed supplemental tariffs would be implemented immediately if the United States implemented the additional 25% tariffs on $200 billion of Chinese products.

August 7, 2018: The Trump Administration released the updated list for the second stage of its tariffs on $50 billion worth of goods that had been announced on June 15, 2018. The remaining portion, $16 billion worth of imports affecting 279 products from China, was subjected to a 25% tariff rate effective on August 23, 2018.

August 8, 2018: China released the updated list for the second stage of its tariffs on $50 billion worth of imports from the United States. Sixteen billion dollars of imports, affecting 333 products from the United States, were subjected to 25% Chinese tariffs effective on August 23, 2018.

August 23, 2018: The Stage 2 tariffs from the United States and China both went into effect, affecting $16 billion worth of goods traded for each country.

September 17, 2018: President Trump finalized the list of 5,745 products accounting for $200 billion worth of imports from China subject to a 10% tariff that went into effect on September 24, 2018.

September 18, 2018: China announced its list of products accounting for $60 billion of U.S. products to be charged tariff rates ranging from 5% to 10%, effective on September 24, 2018. A list of 3,571 U.S. products were subjected to 10% Chinese tariffs, and 1,636 U.S. products were subjected to 5% Chinese tariffs.

September 24, 2018: The Stage 3 tariffs both went in effect in the United States and China, covering $200 billion goods from China and $60 billion goods from the United States.

May 5, 2019: After a deal to halt the escalation of tariffs, and with the expectation of a potential deal with China, there was a sudden reversal during the U.S.–China trade negotiations when President Trump tweeted that the United States would increase the 10% tariff on $200 billion worth of products from China to 25% effective on May 10, 2019. President Trump also confirmed a 25% tariff rate on the rest of U.S. imports from China, which would include consumer products such as toys, footwear, clothing, and electronics.

May 10, 2019: The Stage 3 tariffs imposed by the United States on $200 billion worth of Chinese goods increased from 10% to 25%.

May 13, 2019: In retaliation to President Trump’s May 10 increase in tariff rates, China announced an increase in its own tariff rate on June 1, 2019, covering $36 billion of the $60 billion list from September 24, 2018. Under its augmented tariff announcement, the updated rates affecting 5,140 U.S. products in this $60 billion portion were 5% (595 line items), 10% (974 line items), 20% (1,078 line items), and 25% (2,493 line items). Over 300 U.S. agricultural products valued in 2017 at approximately $3 billion were affected in June 2019 by the increase in Chinese tariffs.

June 1, 2019: The Stage 3 tariff increase went in effect by China on $60 billion worth of U.S. products.

August 13, 2019: Immediately following another round of U.S.–China trade discussions, the United States announced its imposition of a new 10% tariff initially applied to $112 billion of Chinese products starting September 1, 2019, and subsequently applied to $160 billion worth of Chinese goods on December 15, 2019.

August 24, 2019: China responded with 5% and 10% retaliatory tariffs on $75 billion worth of U.S. products, effective September 1, 2019, and December 15, 2019, respectively. For the Chinese list effective on September 1, 2019, 916 U.S. products were subjected to an additional 10% tariff and 801 other products were subjected to a 5% tariff. On the same day, President Trump announced that the tariff rate for the list of $112 billion worth of Chinese products effective on September 1, 2019, would be 15% instead of 10%.

September 1, 2019: The Stage 4A tariffs both went in effect in the United States and China, covering $112 billion worth of Chinese goods and the first part of $75 billion worth of U.S. goods.

December 13, 2019: Both parties announced their agreement under the Phase One trade deal scheduled to be signed in January 2020. President Trump called off the scheduled December 15, 2019, tariff increase on the $160 billion worth of Chinese products, and further stated that the United States would reduce the September 1, 2019, tariffs on $112 billion from 15% to 7.5%. China also called off the additional tariffs on the U.S. products planned for

December 15, 2019.

January 15, 2020: The United States and China signed the Phase One trade agreement. As a result of the agreement no additional tariffs were imposed by both countries, thus aborting the proposed increases scheduled for December 15, 2019. However, other tariffs already implemented would remain in place. As part of the agreement, China pledged to purchase at least $40 billion worth of agricultural products for each of the next 2 years (2020 and 2021).

January 22, 2020: The U.S. Trade Representative decided to reduce its own tariff rate from 15% to 7.5% on the September 1 list of goods, effective on February 14, 2020.

February 6, 2020: After the signing of the Phase One trade agreement, China announced it would reduce its tariffs—from 5% to 2.5% and from 10% to 5%—on the first half of $75 billion worth of U.S. products on the list from September 1, 2019, effective on February 14, 2020.

February 14, 2020: The tariff reductions went into effect for both countries. The United States reduced its tariff rate from 15% to 7.5% for Stage 4A of the September 1, 2019, list. China reduced its tariff rate for the first half of the September 1, 2019, list from 5% to 2.5% and from 10% to 5%

February 17, 2020: China also announced it temporarily would lift the retaliatory tariff for part of the U.S. products under the U.S. 301 investigation beginning March 2, 2020. This temporary lift of retaliatory tariffs included 696 tariff line items, many which are U.S. agricultural products such as cotton (HS code 5201).

March 2, 2020: China temporarily lifted the retaliatory tariff for 696 tariff line items of U.S. products under the U.S. Section 301 investigation. Chinese companies importing these 696 tariff line items from the United States need to submit an exclusion application form to be exempted from the retaliatory tariffs.

U.S. import restrictions:

Stage 1: 25% tariff on approx. $34 billion worth of Chinese products

Stage 2: 25% tariff on approx. $16 billion worth of Chinese products

Stage 3: 25% tariff on approx. $200 billion worth of Chinese products

Stage 4A: 7.5% tariff on approx. $112 billion worth of Chinese products

Stage 4B: proposed 15% tariff on approx. $160 billion worth of Chinese products (indefinitely suspended)

Chinese import restrictions:

Stage 1: 25% tariff on approx. $34 billion worth of U.S. products*

Stage 2: 25% tariff on approx. $16 billion worth of U.S. products*

Stage 3: 5%, 10%, 20%, and 25% tariff on approx. $60 billion worth of U.S. products*

Stage 4A: 2.5% or 5% tariff on first part of $75 billion worth of U.S. products*

Stage 4B: proposed 5% or 10% tariff on second part of $75 billion worth of U.S. products (indefinitely suspended)

*Tariffs for 696 tariff line items on these lists were temporarily lifted beginning March 2, 2020.

From White House; Commerce Department; The State Council, The People’s Republic of China; CRS, 2020; Liu, Robinson, & Shurley, 2018; USDA FAS, 2018a, 2018b, 2018d, 2018e, 2019; Bown & Kolb, 2021; USTR, 2018b.

Tariffs implemented on cotton and textile products because of the U.S.–China trade dispute

The cotton industry was caught in the middle of the trade dispute, and tariffs were implemented by both countries on cotton and cotton-related products (Muhammad et al., 2019a, 2019b). The tariffs not only raised costs, but also altered sourcing strategies in global cotton supply chains. Tables 4 and 5 show the implementation dates of the tariffs on cotton and cotton-related products and the value of the textile and apparel products affected since the initiation of the trade dispute. The additional 25% Chinese import tariffs on U.S. raw cotton resulted in a 26% tariff for in-quota1 U.S. cotton and 65% tariff for out-of-quota U.S. cotton. China also implemented tariffs targeting U.S. textiles and apparel.

Summary of the U.S.–China trade dispute

In the wake of the economic and trade frictions between the United States and China that could jeopardize the highly integrated worldwide industrial supply chain, both countries released several rounds of tariff exemptions and exclusion lists while new tariffs were implemented, and tariff barriers remained in place. Products on the exclusion list are specific products which can only be sourced from either the United States or China, and the additional duties on these specific products would cause severe economic harm to the economy of both countries. Five rounds of exemptions lists were implemented by China and four rounds of exemptions lists and Covid-19 exclusions were implemented by the United States. These exemptions lists have been extended and updated multiple times since the initial implementation by both countries.

The United States’ Section 201 tariffs on washing machines and solar product imports are time-limited by statute. The tariffs on washing machines expired in February 2021 and the tariffs on solar products expired in February 2022. However, the U.S. Section 232 tariffs (on steel and aluminum imports) and U.S. Section 301 tariffs (on Chinese imports) remain in effect until the U.S. president takes action to remove them. The removal of tariffs would not only ease the burden of tariffs and retaliatory tariffs borne by U.S. manufacturers, consumers and farmers, but also it would spur economic growth. It is in the best interest of both countries to find the right solutions to solve these trade disagreements and ease trade tensions.

Table 4. U.S. tariffs on Chinese textile and apparel products.

September 24, 2018: An additional 10% tariff by the United States was imposed on Chinese textile products, affecting $3.7 billion worth of products.

May 10, 2019: The U.S. tariff rates on $3.7 billion worth of Chinese textile products increased by additional 25%.

September 1, 2019: An additional $31 billion worth of Chinese textile and apparel products were subjected to an increased rate of 15%.

December 13, 2019: An agreement was reached under the Phase One trade deal to suspend an additional 15% tariff increase scheduled to go into effect on December 15, 2019, that would have affected $4.7 billion worth of textiles.

February 14, 2020: The additional 15% tariff rate on $31 billion worth of Chinese textile and apparel products decreased to 7.5% after the signing of the Phase One trade deal on January 15, 2020.

Adapted from “US-China tariff war — The textile and apparel hit-list updated,” by S. Lu, 2021.

1Chinese cotton imports are managed through quota and tariff systems. China’s WTO accession agreement specified an 894,000-ton tariff-rate quota (TRQ) each year with a tariff of 1%, and non-TRQ cotton import tariff at 40% (MacDonald et al., 2015). In certain years, China also unilaterally supplemented its TRQ with additional quota with a tariff of 1% (MacDonald et al., 2015).

Table 5. Chinese tariffs on U.S. cotton, textile, and apparel products.

July 6, 2018: China implemented an additional 25% tariff rate on $982 million worth of U.S. cotton (HS code 5201, cotton, not carded or combed) and $ 8.7 million worth of U.S. cotton linters (HS code 140420, cotton linters).

September 24, 2018: China implemented an additional 10% tariff rate on $54,000 worth of U.S. cotton (HS code 5203, cotton, carded or combed), and additional 5% and 10% tariff rates on $486 million worth of U.S. textile and apparel products.

June 1, 2019: The tariff rate for $54,000 worth of U.S. cotton (HS code 5203) increased an additional 25%, and $854 million worth of U.S. textile and apparel products were subjected to additional 10%, 20%, and 25% tariff rates.

September 1, 2019: China implemented an additional 10% tariff rate on $19.5 million worth of U.S. textile and apparel products.

December 13, 2019: Suspension of 5% and 10% tariffs on an additional $1.363 million worth of U.S. textile and apparel products after reaching the Phase One trade deal.

February 14, 2020: China reduced the tariff rate to 5% on $19.5 million worth of U.S. textile and apparel products.

March 2, 2020: China implemented a temporary lift on this date of the retaliatory tariff for part of the list of U.S. products under the Section 301 investigation. This temporary lift included many U.S. agricultural products, including cotton (HS code 5201).

From UN Comtrade Database for U.S. Cotton, and Lu, 2021.

References

Bown, C. P., & Kolb, M. (2022). Trump’s trade war timeline: An up-to-date guide. Peterson Institute for International Economics.

Congressional Research Service. (2020). Trump administration tariff actions: Frequently asked questions (Report No. R45529).

Flaaen, A., & Pierce, J. R. (2019). Disentangling the effects of the 2018-2019 tariffs on a globally connected U.S. manufacturing sector. Divisions of Research and Statistics and Monetary Affairs Federal Reserve Board.

Furman, J., Russ, K. N., & Shambaugh, J. (2017). US tariffs are an arbitrary and regressive tax. Centre for Economic Policy Research.

Foreign Agricultural Service. (2018a). China announces supplemental tariffs in response to U.S. 301 tariffs (GAIN report). United States Department of Agriculture.

Foreign Agricultural Service. (2018b). China implements supplemental imports tariffs on U.S. products exported to China (GAIN Report). United States Department of Agriculture.

Foreign Agricultural Service. (2018c). China lowers selected MFN tariffs on November 1 (GAIN report). Department of Agriculture.

Foreign Agricultural Service. (2018d). China responds to U.S. 301 announcement with revised product list (GAIN report). United States Department of Agriculture.

Foreign Agricultural Service. (2018e). China updates list of U.S. products subject to additional tariffs (GAIN report). United States Department of Agriculture.

Foreign Agricultural Service. (2018f). China: China raises tariffs on U.S. agricultural products (GAIN report). United States Department of Agriculture.

Inouye, A. (2018). China: China imposes additional tariffs on selected U.S.-origin products (GAIN report). United States Department of Agriculture Foreign Agricultural Service.

Li, M., Zhang, W., & Hart, C. (2018). What have we learned from China’s past trade retaliation strategies?. Choices, 33(2), 1–8.

Liu, Y., Fonsah, E. G., Russell, L. A., Rabinowitz, A. N., & Shurley, W. D. (2018). The impacts of China and United States trade and tariff actions on Georgia agriculture (Publication No. TP104). University of Georgia Cooperative Extension.

Liu, Y., Robinson, J. R. C., & Shurley, W. D. (2018). China’s potential cotton tariffs and U.S. cotton exports: Lessons from history. Choices, 33(2), 1–6.

Lu, S. (2021, January 4). US-China tariff war — The textile and apparel hit-list updated. JustStyle. Retrieved January 19, 2022, from https://www.just-style.com/analysis/us-china-tariff-war-the-textile-and-apparel-hit-list-updated_id136519.aspx

Lu, Z., & Schott, J. J. (2018). How is China retaliating for US national security tariffs on steel and aluminum? Peterson Institute for International Economics.

MacDonald, S., Gale, F., & Hansen, J. (2015). Cotton policy in China. U.S. Department of Agriculture Economic Research Service.

Muhammad, A., Smith, S. A., & MacDonald, S. (2019a). Impacts of the trade war on the US Cotton Sector. University of Tennessee Extension Publications.

Muhammad, A., Smith, S. A., & MacDonald, S. (2019b). How has the trade dispute affected the US cotton sector? Choices, 34(4), 1–9.

Office of the United States Trade Representative (USTR). (2018a). Findings of the investigation into China’s acts, policies and practices related to technology transfer, intellectual property, and innovation under Section 301 of the Trade Act of 1974. Executive Office of the President.

Office of the United States Trade Representative (USTR). (2018b). USTR finalizes tariffs on $200 billion of Chinese imports in response to China’s unfair trade practices. Executive Office of the President.

Status and Revision History

Published on Dec 09, 2022